The DBS report from the major Singaporean bank shows that the interest from central banks in crypto has increased during the ongoing COVID-19 pandemic so let’s find out more in the upcoming cryptocurrency news.

The multinational banking corporation DBS bank compiled a new DBS report on crypto which shows that the central banks are intrigued but also afraid of the growing role of digital assets in the world of today, especially during the ongoing COVID-19 pandemic. The bank is among the biggest banks in the region and in the recent paper on crypto, it said that while banks are speculative of crypto assets and that there’s no real-life utilization, they have now outgrown this opinion and are really looking into crypto further. The current pandemic and the actions taken by the central bank only show how they are speeding up in this sector:

“Ever since central banks around the world embarked on an unprecedented expansion of their balance sheets to combat the COVID-19 pandemic-related economic headwinds, interest in cryptocurrencies, along with gold, has resurged.”

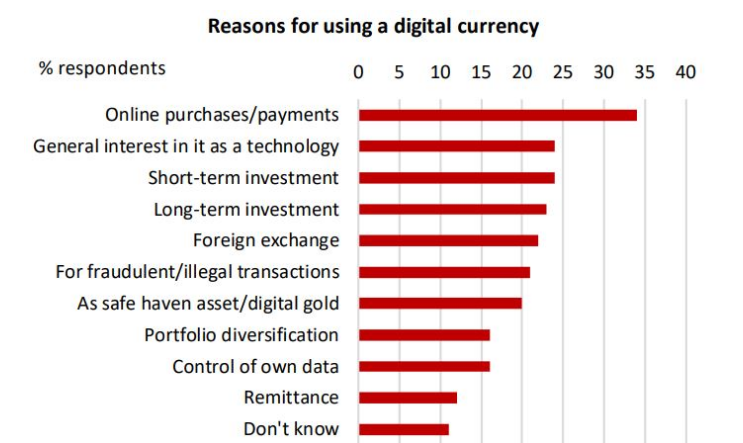

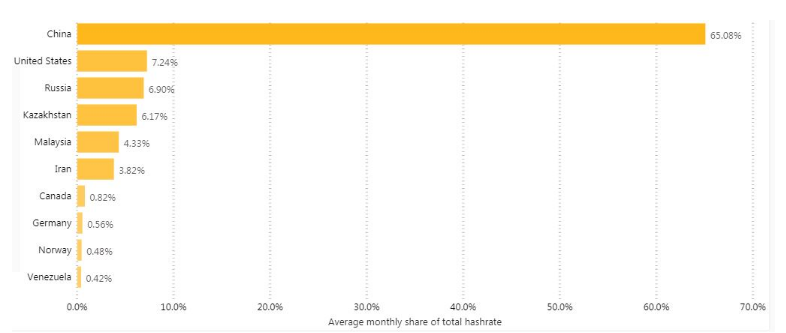

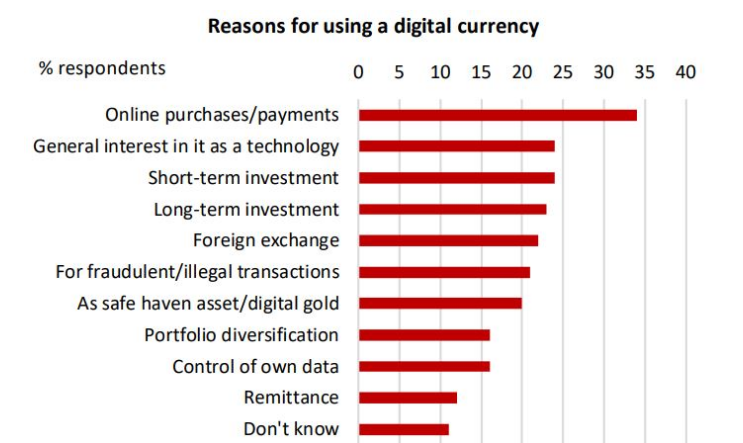

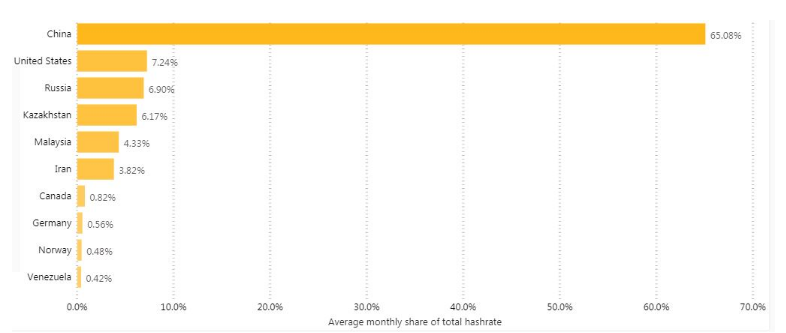

The paper outlined that bitcoin’s maximum cap of 21 million makes it a really interesting investment or a store of value which also brings up a poll that indicates the same results. About 35% of participants responded that they employ BTC and other assets for online payments. Less than 25% said that there’s a general interest in crypto as technology and short-term investment. The document asserts that Asian countries are the most fund of cryptocurrencies and digital payments and China is the leader with a huge difference from the United States.

The DBS report also shows that Singapore is the global hub for initial coin offerings as the Parliament last year passed a Payment Services Act to make the Monetary Authority of Singapore responsible for regulating it. Hong Kong is the home of crypto exchanges as the Securities and Futures Commission introduced a new law back in 2018 which brought fund managers under the regulation:

“Measured by traffic, liquidity and trading volume, half of the world’s top ten cryptocurrency exchanges are in Asia.”

The biggest continent is now a leader in digital payments as China comprises about half of the worldwide transaction value.

The DBS report from the major Singaporean bank shows that the interest from central banks in crypto has increased during the ongoing COVID-19 pandemic so let’s find out more in the upcoming cryptocurrency news.

The multinational banking corporation DBS bank compiled a new DBS report on crypto which shows that the central banks are intrigued but also afraid of the growing role of digital assets in the world of today, especially during the ongoing COVID-19 pandemic. The bank is among the biggest banks in the region and in the recent paper on crypto, it said that while banks are speculative of crypto assets and that there’s no real-life utilization, they have now outgrown this opinion and are really looking into crypto further. The current pandemic and the actions taken by the central bank only show how they are speeding up in this sector:

“Ever since central banks around the world embarked on an unprecedented expansion of their balance sheets to combat the COVID-19 pandemic-related economic headwinds, interest in cryptocurrencies, along with gold, has resurged.”

The paper outlined that bitcoin’s maximum cap of 21 million makes it a really interesting investment or a store of value which also brings up a poll that indicates the same results. About 35% of participants responded that they employ BTC and other assets for online payments. Less than 25% said that there’s a general interest in crypto as technology and short-term investment. The document asserts that Asian countries are the most fund of cryptocurrencies and digital payments and China is the leader with a huge difference from the United States.

The DBS report also shows that Singapore is the global hub for initial coin offerings as the Parliament last year passed a Payment Services Act to make the Monetary Authority of Singapore responsible for regulating it. Hong Kong is the home of crypto exchanges as the Securities and Futures Commission introduced a new law back in 2018 which brought fund managers under the regulation:

“Measured by traffic, liquidity and trading volume, half of the world’s top ten cryptocurrency exchanges are in Asia.”

The biggest continent is now a leader in digital payments as China comprises about half of the worldwide transaction value.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post