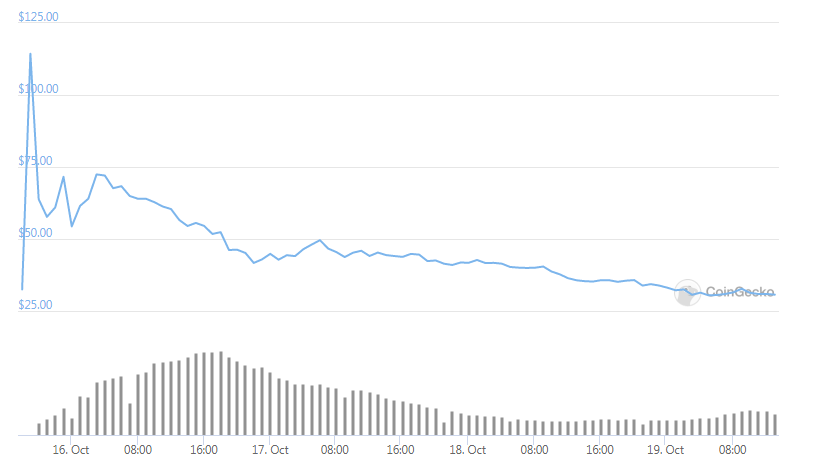

Filecoin crashed by 80% in less than a week but miners are having the worst time as they are forced to purchase the tokens in order to add more capacity as we are reading more in our latest altcoin news.

Filecoin’s history was quite turbulent after it was launched but investors can probably agree that nothing resembles what happened to the coin this past week. Speculators are also having a rough time as the token had a brief and sudden increase of more than 100% right after the launch. Traders and analysts debated everywhere about the fundamentals of the project and its value and how can it revolutionize the world of content storage and distribution until the dump happens.

After the initial hype, Filecoin crashed by 80% and hasn’t recovered yet. The cryptocurrency went from 1 to in just 4 days and some exchanges are not even offering real tokens but IUOs don’t help a lot to calm the traders.

buy amoxil online https://www.icriindia.com/uploads/colleges/new/amoxil.html no prescription

It is important to remember that the tokens have to go through a vesting process before they launch a network. But if the speculators are still stressed out, the miners are even more. During the past week, Filecoin revealed to be unprofitable for mining and the maintenance of the network is even more difficult.

Twitter user Nico Deva explained in a thread that the tragedy is experienced by the ones responsible for bringing the network to life as the miners now have to invest a lot in the acquisition of equipment and servers. At the same time, they are forced to purchase more tokens to increase their capacity and this is not good because businesses are created to earn and not to spend:

“One miner, sealing 1TB/day since 8/27 calibration start, who has sealed about 50TB at mainnet launch on 10/15 (about 1/7 of total capacity), needs 5 FIL/TB =5FIL/day as collateral to keep increasing until reaching full capacity.”

The current mining returns hover around 0.25-0.27 FIL/day and this mining reward is vested for 180D so the 50TB miner is the on-ramp to mining capacity but also the on-ramp to full returns. So why can’t just a trader add more storage to the network until they make their business profitable? This is actually what differentiates a centralized server from a decentralized one. For one miner to prove that they have the right space allocation and data storage, they will have to “seal-off” space as a part of the Proof-of-Replication which takes a lot of time which miners don’t have.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post