Quadriga trustees have finally laid out options for compensating the users as EY received at least $171 million in claims from the affected users of the now defunct exchange. In today’s crypto news, we can see that the exchange has about $30 million to distribute.

QuadrigaCX is bankrupt but 17,053 users filed claims worth a collective of $291 million. EY, the Quadriga trustee filed a report with a Canadian court outlining how it believes recovered funds should be distributed. Back in 2018, the founder of the exchange Gerald Cotten died. Two years later, users of the crypto exchange tried to get their money back but they are still unable to do so.

The big four accounting firm EY, the trustee in the ongoing bankruptcy case, filed an update with the Ontario Superior court of Justice Today, suggesting that they deal with all affected user plans in the same way with two rates at which claims could be paid and asked the court to process claims with minor errors as is. With the Canadian exchange shuttering, there were 76,000 users that the exchange owed money to. The funds that had been coming in from eh users were used by Cotten to feed a Ponzi scheme and he was at the top of the pyramid. Slowly, EY helped to claw some of the funds back like settling with Cotten’s widow, selling assets from his estate, and going after the funds with a third-party payment processor that the exchange used.

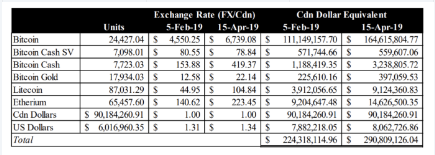

EY received 17,053 claims from users who had funds in the exchange or they thought they have funds in the exchange’s cold wallets. Funds were funneled into an account which was controlled by the founder of the exchange. Many users held different fiat and cryptocurrencies so each user claim is subdivided into 42,957 claims for individual currencies. Users are seeking more than $6,016,960 in addition to various cryptocurrencies.

EY says it will convert all of the assets that it has recovered into the Canadian dollar and use the conversions from 2019 when the exchange declared bankruptcy or when the users were first locked out of the platform. This will have an impact on the total amount that is paid off, so now EY is asking the court to decide the date to use. The report also noted that some claim forms had errors like no signatures or wrong account numbers. The auditing company believes it will cost more to follow up and to fix them than to just accept them and get on with the potential refunds.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post