Bitcoin is bigger than Netflix, Bank of America, and Shopify as it is set to become ranked among the top 20-assets by market cap worldwide, leading ahead from companies like PayPal and McDonalds as we are reading more in the latest Bitcoin news today.

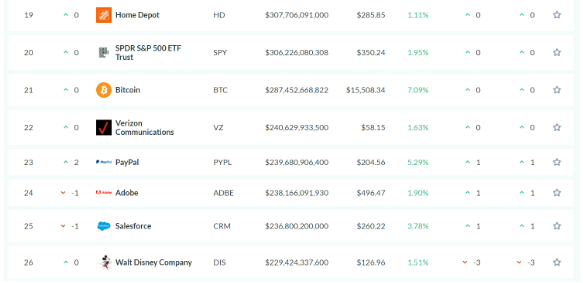

Bitcoin is set to enter the top 20 assets by market cap as it is now ranked at $21. At $288 billion, the market cap surpassed that of major corporations and national banks. moving up the list would place BTC in the ranks of Apple, Tesla, and Google, as now Bitcoin is bigger than Bank of America. Bitcoin is now worth $15,559 with a market cap of $288.3 billion making it the 21st biggest asset in the world by market cap according to Asset Dash.

The ranking places BTC them a place above Bank of America which got down by 30% since January due to the lower interest rates and the higher loan defaults during the covid-19 crisis. BoA stocks have had a rocky week with plunging Treasury yields and election uncertainty. Higher on the list are JPMorgan Chase and Co, Visa, Tesla, Facebook, and Walmart. The top three companies are Amazon with $2.02 trillion, Microsoft with $1.68 billion, and Apple with $1.66 billion.

Bitcoin’s increase up the list marks the stunning progress that bitcoin made in recent years towards mainstream recognition as one of the best-performing assets in the world. Today, Bitcoin also got featured on the front page of the investing community on Reddit with 1.2 million members, most of which are likely retail investors. The major institutional investors are now betting on BTC during the economic and political uncertainty and weakened the US dollar. Both demographics will likely push BTC into the top 20-global assets soon.

Speaking on the Bitcoin price recently and the FED Chairman Jerome Powell, he pledged to keep supporting the economy by trying to maintain the benchmark interest rates near zero for about three years. In the meantime, he proposed to make upwards adjustments in the FED’s asset purchasing program and the bank now buys $120 billion worth of Treasury and mortgage-backed securities. The statements stressed the US dollar as the greenback fell to 0.94 percent as talks of central banks’ spending only poses risks of hurting the purchasing power. Its dip prompted investors to look for opportunities somewhere else with Bitcoin emerging as an ideal candidate thanks to the consistent uptrend since the previous two weeks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post