UNI liquidity drops 50% as the funds started flowing to Sushiswap during the liquidity exodus that is still ongoing. The liquidity incentives ended on decentralized exchange protocol Uniswap as we are reading more in our altcoin news today.

For all of the unintended, Uniswap is an automated market maker that has a pool of funds from the users of different trade pairings like ETH/USD or UNI/ETH and makes automatic matched-trades. In return, it pays all of the pool contributors a fraction of the trading fees that are generated on the platform this giving them an incentive to continue to pool their funds and to then stake liquidity tokens on other DeFi apps for more yields.

As a result, the pools get influenced by other pools that are generating the highest yields for users which means a majority of the user base is profit-seeking rather than loyal to one Decentralized exchange which only contributes to a scenario where the protocols are giving out high yields and temporarily attract the most funds but then lose the users once these yields dry out. Uniswap was no exception to this issue. the UNI liquidity drops 50% from the $3 billion range to $1.3 billion, which only suggests that the incentives are a huge part of the Uniswap allure.

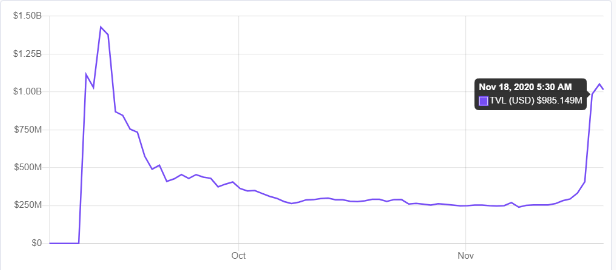

The data from DeFi pulse shows that this looks like a “rug-pull” from Uniswap’s liquidity data. The total value locked increased steadily in the past year to $3 billion but then crashed to levels seen in early September. The winners from Uniswap’s incentive-ending move were some other DEXs like 1Inch, Sushiswap, and Bancor. Bancor showed off with its new liquidity mining program which includes a retroactive reward program and its TVL went up by about 50% on Wednesday. More than 125,000 ETH were locked on the platform while 1inch introduced a new reward program with 1% rewards of its token supply to its liquidity providers.

1) Dear guests,

We are happy to reveal our improved permanent Menu a thread for our valued LP. pic.twitter.com/m5cy93txbD

— SushiChef (@SushiSwap) November 16, 2020

SushiSwap seems to have attracted a huge amount from Uniswap since the project saw plenty of controversies earlier this year as the founder of the platform left the platform and introduced a new farming reward platform to the existing pools. It attracted hundreds of millions of dollars in less than three days as the Defi Pulse data shows. Sushiswap’s TVL was small but skyrocketed from $250 million to $1.05 billion today. In the meantime, the native SUSHI token saw the price moving up and increase to about 40% in the past day.

SUSHI is now the 79th biggest cryptocurrency with a market cap of $167 million and it could increase further if it attracts more funds in the upcoming days.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post