It seems like there are new Grayscale trusts that have been registered in Delaware, for Cosmos, Polkadot, and Aave as well as the privacy coins Cardano and Monero. The company is eyeing the DeFi space as we can more In today’s crypto news.

Grayscale Investments is the world’s biggest digital asset manager and it seems that there are new Grayscale trusts that were registered in Delaware. The Delaware corporate registry lists trusts for Cosmos, Aave, Polkadot, Monero and Cardano. As with other trusts that were filed previously, the registrations were made by the Delaware Trust Company that is Grayscale’statutory trustee for the state.

The filings mean that the trusts will be launched for the four new assets but they don’t indicate that the asset manager is going to lay the groundwork for potential launches. Grayscale registered trusts for Chainlink, Decentraland, Basic Attention token, Tezos, and Livepeer in the past few months. At that time, the company said:

“Occasionally, we will make reservation filings, though a filing does not mean we will bring a product to market.”

As reported previously, Grayscale is now looking for other opportunities to start offering products that meet the investors’ demands. The company will make reservation filings occasionally though a filing that does not mean that they will bring the products to the market. Grayscale will continue announcing when the new products are made available to the investors. As such, the filings could offer a new hint of which the crypto trusts will be launched. Another registration for the Filecoin trust was also made on October 15, 2020. The New York-based Grayscale is actually owned by Digital Currency Group.

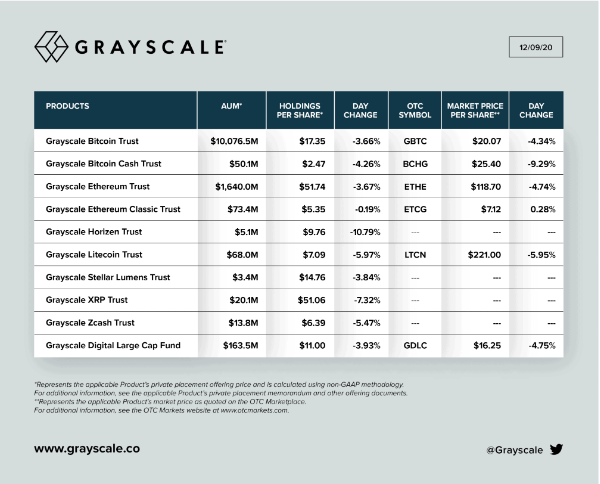

Unfazed by the recent market volatility, the data shows that the institutional players are adding to the BTC positions. According to the data aggregator Bloqport, Grayscale added $120 million to its coffers over the past day. This adds to the $1 billion that the company purchased over the past seven days. This means that the company has over $20 billion worth of cryptocurrency under management which marks an increase of 7 percent in BTC terms over the past month alone. It’s still unclear if Grayscale is the preferred method for investors in Corporate America or Wall Street to allocate the capital they have into BTC as they are an increasing number of institutional providers that are able to execute or custody BTC. The company is expected to add new funds soon for the institutional players to obtain more exposure to altcoins.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post