Aave launches new market for real-world assets so now the users can earn yield by helping smaller businesses to tap liquidity from crypto markets thanks to the new partnership with Centrifuge as we are reading more in today’s latest cryptocurrency news.

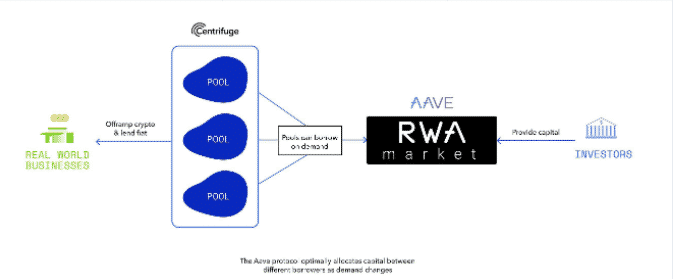

The Defi Money market platform Aave launches new market for real-world assets rather than cryptocurrencies. Aave users can only borrow and lend crypto with the rates adjusting based on the market demand. The initiative is in partnership with Centrifuge which is a crypto company that allows businesses to tokenize the aspects of the operations like trading receivable and invoices so once tokenized, the assets can be used as collateral to borrow the cash.

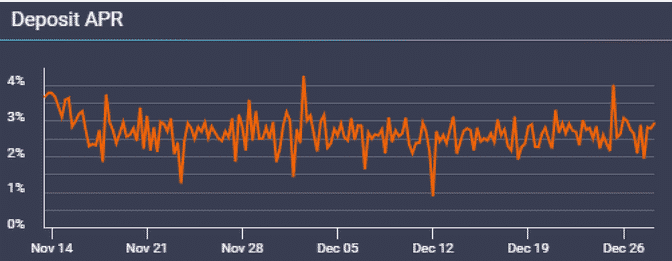

The users can lend DAI as a popular decentralized stablecoin pegged to the US dollar and earn a 2.8% yield for example and now the users can borrow DAI at a cost of 3.97% and these values fluctuate based on how high the demand is to borrow the DAI and how much liquidity is available to borrow. There are 30 additional markets on Aave that offer the same services. With the price launch today of RWAs on Aave, other permissioned markets opened up and it means that the interested users will have to complete know your customer processing before joining. Not only does the initiative offer the lenders some more markets to earn interest on the holdings, but it will also provide the businesses behind the markets to access liquidity that they may not have had access to in the first place. Stani Kulechov who is the founder of Aave said:

“The RWA Market is a much-needed building block not only for protocols such as Aave but across DeFi as a whole. Knocking down barriers of entry and making DeFi accessible to all is part of the Aave Companies’ vision, and we are excited to be fulfilling this through the collateralization of real-world assets, made possible by Centrifuge.”

The main feature of the markets is the tokenization that can be understood as securitization in traditional finance of the business’ operations. Built on Centrifuge, Tinlake is the main platform that will help businesses do exactly that. There are about 11 different RWA markets on Tinlake and range from tokenized real estate, payment advances, and invoices so one tokenized, investors can buy these tokens that behave similar to bonds and earn a yield on the holdings and this yield can range from 3% to 10% depending on the market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post