The DeFi Token Ampleforth is now live on the Avalanche network as one of the fastest-growing networks out there as we are reading more about It in our latest altcoin news today.

The Defi token Ampleforth is now live on Avalanche, launching its algorithmic unit of account on the Ethereum competitor. Evan Kuo, the CEO of Fragments Inc which is the company of development behind the Ampleforth Protocol noted:

“With the changing regulatory landscape and uncertainty around what the verdict around stablecoins will be, it’s important for DeFi to have a financial building block that’s decentralized, uncensorable, and have some aspect of price predictability or stability.”

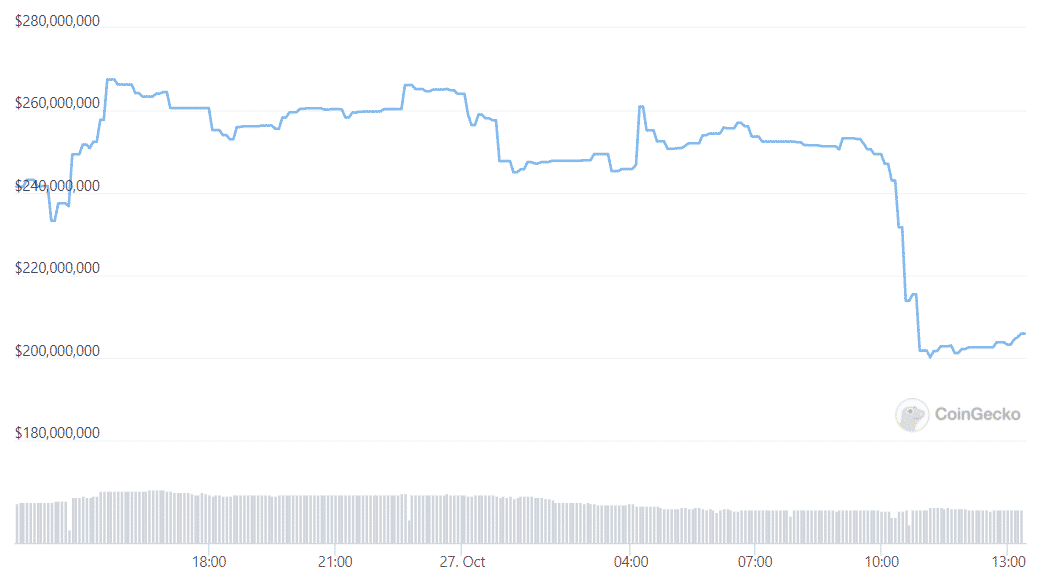

The Ampleforth protocol adjusts total supply daily by transferring volatility from price to supply and the protocol’s supply does not rely on the lenders or traditional banks. Ampleforth adjusts its total supply through a mechanism called rebasing so all holders of the AMPL token will have their tokens burned if the price of the coin falls below $1 or the holders will receive more tokens if the price surpasses $1. The rebasing events however were volatile and had some double-digit rises and falls but at press time the token is trading at $1.62. Kuo added:

“It is ironic that the DeFi ecosystem currently relies so heavily on centralized stablecoins for liquidity and lending collateral.”

Avalanche is a layer one blockchain that offers Ethereum Virtual Machine compatibility and the Defi ecosystem built on the blockchain grew to heights of over $8 billion TVL. What’s more to it, it composed more than 40 decentralized exchanges and protocols so, in fact, Avalanche saw about 8% of the DeFi’s current TVL which is up approximately $105 billion. The Defi industry grew to a new high over the past year but that progress didn’t come without any regulatory scrutiny. Earlier this summer, SEC Chair Gary Gensler said that most Defi platforms will be hosting unregistered securities and added that these platforms can implicate the securities laws but some platforms can also implicate the commodities and the banking laws. Gensler doubled down and said that Defi will end poorly if the robust investor protections are not put into place.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post