Chainlink stays afloat despite the major crypto correction but analysts believe this will not continue for a long time. over the past 24-hours 50 BTC that were not touched in over a year was transacted and the Twitter community speculated that it was Satoshi Nakamoto himself moving the holdings. In today’s Chainlink news, we take a closer look at the price analysis.

It was revealed later that the transaction had nothing to do with Satoshi Nakamoto but the damage was done. Bitcoin crashed from the ,800 price point to ,100 which is a 7% drop in just a few hours.

buy stromectol online https://www.phamatech.com/wp-content/themes/twentynineteen/inc/new/stromectol.html no prescription

The sudden bearish impulse resulted in the liquidation of $40 million worth of long positions on the exchanges such as BitMEX which set the alarm for another decline. In the meantime, Chainlink stays afloat and the strength is quite impressive but it could be coming to an end.

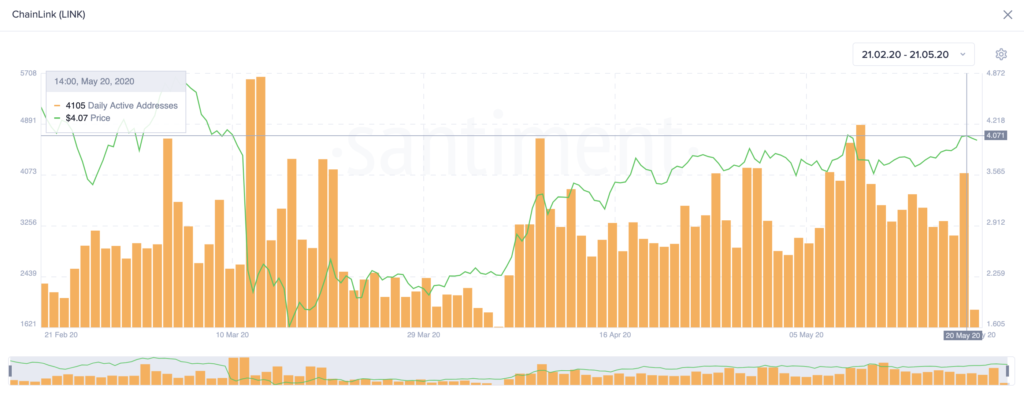

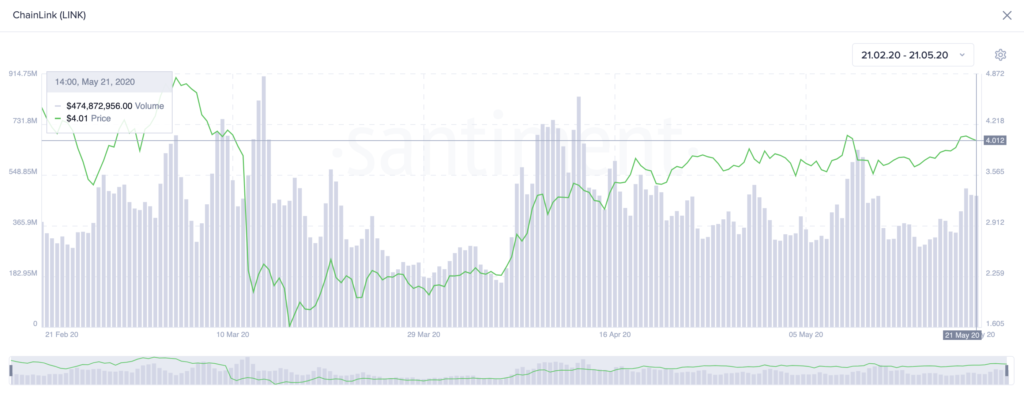

Despite the pessimism around the movement of the smaller coins, Chainlink is staying strong to their tokens. The decentralized oracles crypto was barely affected by the news and continued to go up. The optimism can be noticed on the LINK network activity according to Santiment. The daily active addresses remained in a historic 32-month uptrend since it increased 4.2% in one day. The on-chain volume is increasing since the marketwide correction thanks to the Bitcoin halving, was a good sign.

The Tom Demark Sequential Indicator presented a sell signal in the form of a sequential 13 on the chart. The bearish formation combined with the upcoming green nine candles, shows that LINK could be poised for a one to four daily candlestick correction. Out of all of the addresses, more than 82% are now ‘’In the Money’’ while 17% are ‘’out of the money’’ according to the IntoTheBlock model.

The figures show that LINK holders are confident about what the future holds but looking at the accuracy of the TD index, there is a high chance of another decline. If another correction is to happen, the IOMAP shows that more than 13,600 addresses bought 14.5 million LINK at an average price of $3.75. If the massive supply wall crashes, there is a chance of another trip between $3.45 and $3.57. More than 4,000 addresses are holding 19 million LINK which could serve a strong support level.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post