The Defi liquidity project Moonsafe audit shows some weird anomalies that put it in a controversial spot as of late because these anomalies resemble a scam as we can see in our latest crypto news today.

An analysis of the MoonSafe code by Obelisk reveals misleading claims about the liquidity provider and how the tokens are secured. The LP tokens are minted and sent to the providers’ addresses as evidence of providing liquidity. They have utility and value and are often used to yield farm so therefore they multiply the gains from the initial act of providing liquidity. However, the latest Moonsafe audit shows that the LP tokens are now accessible by the founders.

“One of the main issues with the whole project is that while users are lead to believe that the Liquidity Provider tokens (essentially the receipt for having provided liquidity) are in fact locked and inaccessible from the founders, the exact opposite happens.”

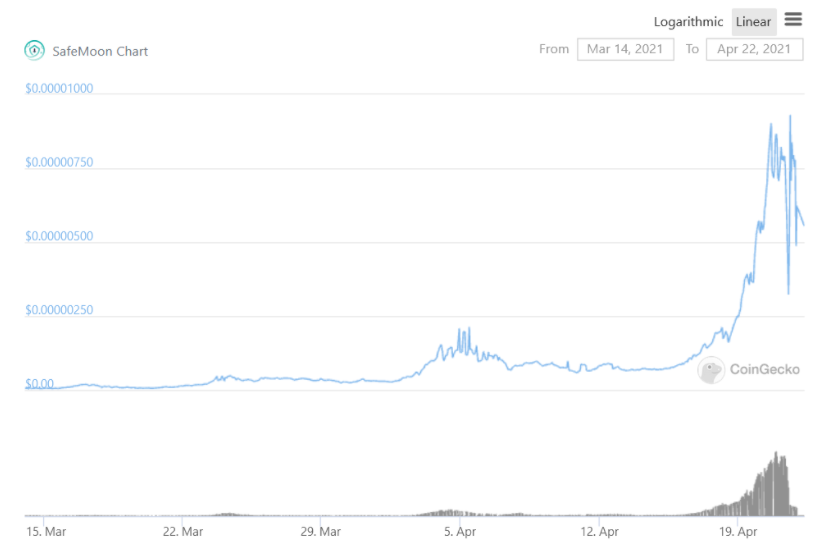

MoonSafe gained a bit since its inception as it hit 11,500% during its peak time. However, a series of events tanked the price. The main concern related to allegations that the project is a rug pull to fill the pockets of its founders.

buy zoloft online https://buynoprescriptiononlinerxx.com/dir/zoloft.html no prescription

The whitepaper review outlined a few inconsistencies like vague statements on the lock and the burn process with other red flags like a roadmap that doesn’t go beyond 2021.

“SafeMoon was advertised as “anti-rugpull” and as having its liquidity locked for 4 years… And to this day the website of the project remains very ambiguous as to how the locks and burns happen.”

Obelisk audited the code of the DeFi project which revealed there were even more reasons to be concerned. They allege fees for providing liquidity which is directed to a wallet that is controlled by the developer.

buy zovirax online https://buynoprescriptiononlinerxx.com/dir/zovirax.html no prescription

To address this, Obelisk recommended an additional step to divert these funds in a smart contract with predefined community-centric functions:

“To mitigate risks, SafeMoon ownership could be transferred to a smart contract that could be programmed to handle funds securely only using predefined functions. This would be a particularly important factor in terms of security and trustlessness.”

Obelisk continued:

“This is particularly worrisome as the developers could essentially pull out the liquidity and market sell against any other liquidity provider with the coins that they had received from reflection fees from users. This is the perfect conditions to pull the rug under the users feet.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post