Solana and DOT are the least impacted coins by the crypto crash as the research from Messari shows which are reading more about in our latest altcoin news.

Written by Roberto Talamas, the report determined the smart contracts Solana and DOT were among the least affected by the event. The strong selling pressure caused the main cryptocurrency to correct by more than 50% back in May and then at the start of June, the market closed on a positive note for the first time. As Talamas noted, the smart contact sector saw a return of 3.11% in assets like DOT, ATOM, Solana, CKB, and KSM.

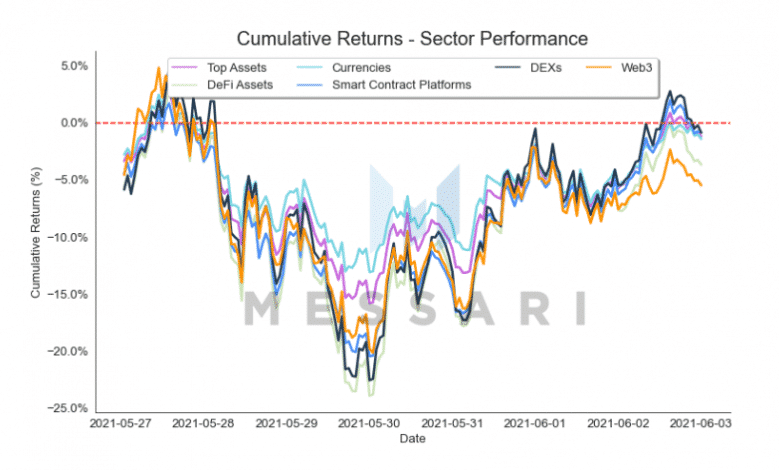

As it can be seen in the charts, Defi Projects and decentralized exchanges have equal returns of 2.70% followed by cryptocurrencies that have the least returns after web3 applications. The crypto market’s performance for the week of June 3rd was quite bumpy as the research said and he added that the asset prices on the board are tumbling down by the mid-week which resulted in losses of 10-25% and starting now, the portfolio found footing as the prices bounced back.

During this week, Talamas added a V-shaped pattern which hints a potential recovery. However, DeFi and Web3 started underperforming by the end of the week and saw moderate losses. Chainlink, Aave, Uniswap were the worst-performing assets in the Web3 as well as Defi sectors because UNI lost 3.5%, Aave lost 4.7% and LINK lost 6%. Talamas added:

“(Volatility) remains elevated across all sector portfolios following the spike that was triggered by the market crash in mid-May. Before the crash, volatility across sectors was roughly the same, ranging from 3-6%. After the crash, sector volatility has become widely dispersed.”

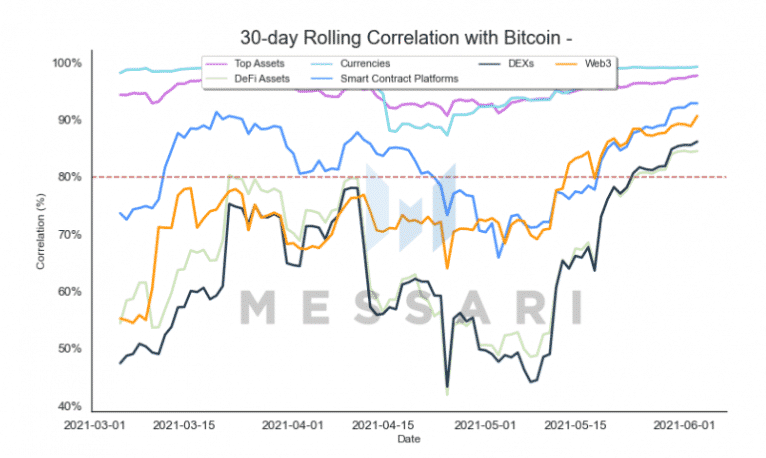

With volatility, the correlation between Solana and all assets has to be increased. The metric reached 85% and 95% for certain pairs and as it can be seen on the charts, the correlation with Bitcoin has been increasing. Talamas pointed out that the trend started at the start of May and during this period, some assets recorded losses. The DeFi and DEX sector is the most correlated to BTC and Solana and the Smart Contract platform that recorded the least correlation with a 20% increase in the past month:

“The correlation between Ethereum and all sector portfolios is now equal to or above 90%. Aside from the portfolios that have a hefty allocation to Ethereum (Smart Contract Platforms and Top Assets), the DeFi and DEX portfolios are the ones with the highest correlation coefficients standing at 94% and 93% respectively.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post