S&P 500 sees five days of losses while bitcoin and the rest of the market had a shaky time as well. In today’s altcoin news, we are reading more about the price analysis.

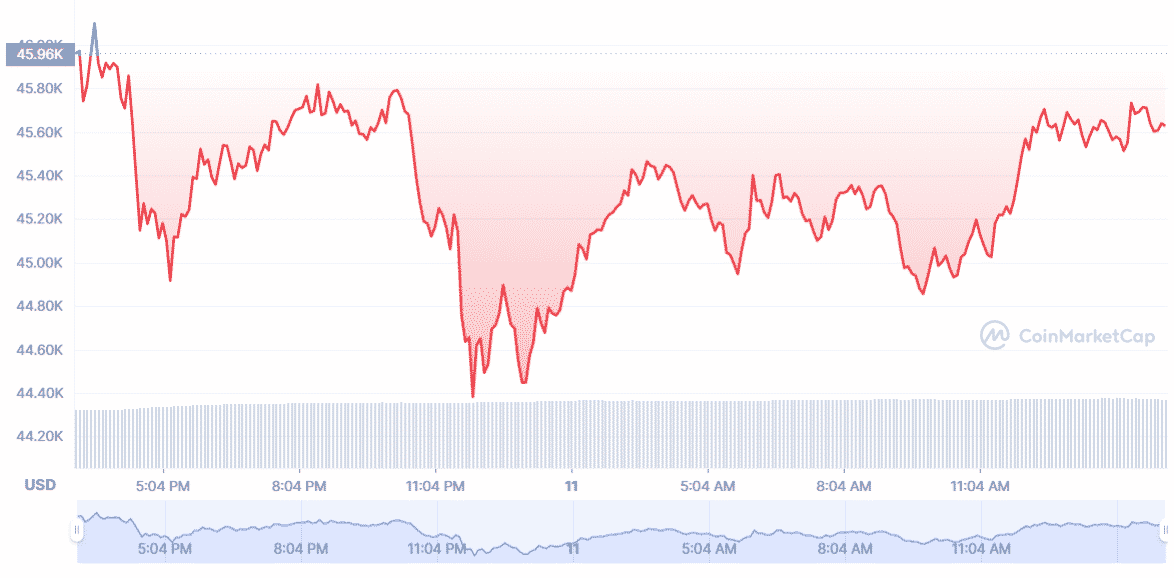

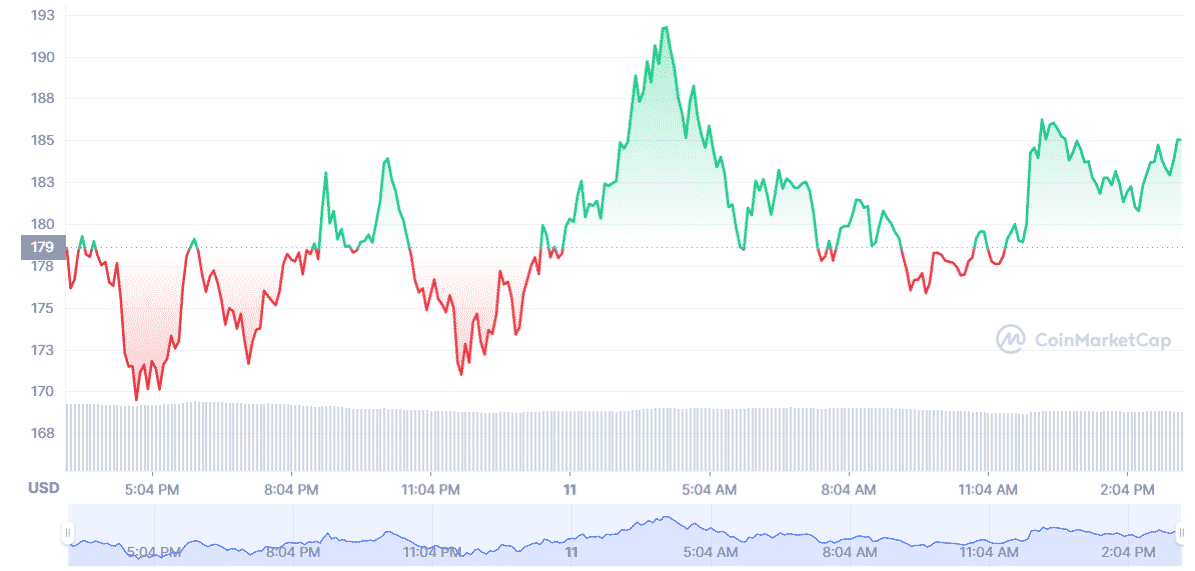

The index of the 500 biggest publicly traded companies, S&P 500 sees five days of losses and ended the week 1.7% lower than where it was on Monday morning after it slipped 0.8% today. Crypto markets are also slowing down and they dropped from a cumulative market cap of $2.43 trillion to $2.2 trillion today which marks a 9% fall. Most o of that happened during the Monday corrections but after stabilizing, the markets dropped to close out the week. As per the figures from CoinGecko, BTC dropped 3% in the past day and Ethereum dropped by 7% while Solana dropped by 9%.

There are clearly a lot of numbers but what does this mean? These data points show cryptos may or may not react to the same stimuli as the S&P 500 does. The index and BTC sometimes move together despite the latter being pitched as a safe haven against inflation. In 2020, after plenty of years of negative correlation or positive correlation, these two started moving more similarly. The correlation coeeificnet ranging from -1 to 1, hit 0.22 which means they are 22% alike roughly.

BTC was more aligned with gold especially in 2020 which is another safe-haven asset. These two assets both embraced by a Venn diagram of economic libertarians are correlated 34% which has since turned negative. Still, the increasing degree of correlation in 2020 only reflected growing the institutional interest in BTC as companies like Square and Microstrategy purchased the asset, and banks, as well as other investment companies, dipped their toes in eh water. BTC became a financial instrument that the mainstream investors could deploy so it started acting similar to other asset classes.

This however has yet to prove to be a fluke. Over the past year, the two markets are just 15.5% correlated as per the data from Skew and that correlation was dropping since November when it was closer to 46%. on a monthly basis, it has been all over the board since past October. This doesn’t say anything about the correlation between Solana as a newcomer and stock trading nor does it for ETH and crypto company ETFs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post