Thailand’s crypto adoption is booming, with record volumes above 588% since November while P2P platforms are falling out of favor as we can see more in our latest crypto news.

With Thailand’s crypto adoption booming Thailand, the local Securities and Exchange Commission estimated that the domestic volumes increased by almost 600% since November. The data by the Thai SEC published by Bloomberg indicated that the combined volume on licenses Thai crypto exchanges increased from 4.

buy ivermectin generic ivermectin without prescription online

5 million in November to $3.96 billion in November.

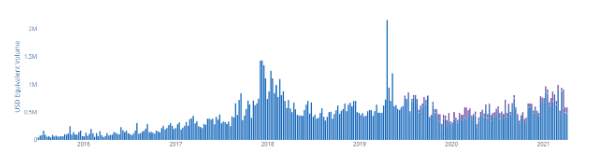

Speaking to the co-founder of exchange BitKub Atichanan Pulges, he believes that the volume on his platform increased by 40% between January and February while he claimed that BitKub represents about 90% of the local trade activity with more than 300,000 customers. Despite the surge in licensed crypto volumes, P2P trading is not growing any longer. Roughly $650,000 worth of BTC traded on the P2P marketplace LocalBitcoins and Paxful in November with the volumes in February oscillating between $700,000 and $1 million with an increase of 10% and 50%. In March, the Thai P2P BTC trade volumes dropped from $950,000 to $600,000.

In response to the rising popularity of crypto, Thailand’s SEC proposed introducing a training course and a test to restrict the traders from speculating on the assets. Last month, the commission hinted that it will introduce a $32,000 minimum annual income requirement for the traders. Alongside the increase in trading, Thailand seems to be having a DeFi boom with the country ranking with a report from The Defiant, ranking the country as second worldwide by search traffic for the “decentralized finance” keyword over the past year.

The report found that Thailand is among the top emerging economies for traffic to top Defi protocols with the visitors representing the second biggest segment of traffic to Badger Finance that ranked third on MakerDao and fifth on Curve.

As reported recently, IBM and Thailand’s central bank used the blockchain technology running on the IBM Cloud to launch the first DLT-based platform for government savings bonds. In the first two weeks of operation, the blockchain-based platform issued $1.6 billion of these bonds. The announcement from IBM read that the platform will now enable investors to benefit from fast bond issuance thus reducing the process which usually took over 15 days to two days. IBM Cloud’s blockchain will reduce the operational complexity and the entire process of issuing bonds.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post