UNI risks falling again by another 10% as the decentralized exchange undergoes the first governance vote so let’s read more about it in the latest altcoin news.

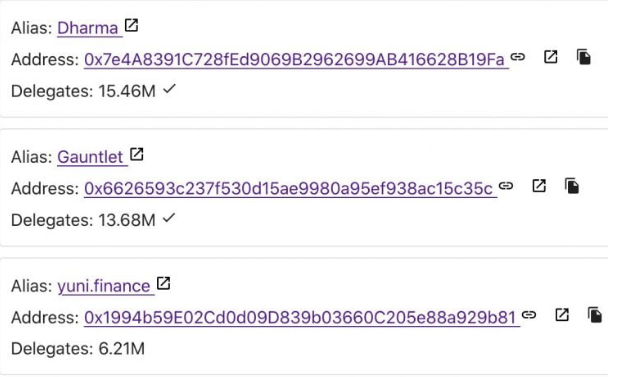

Uniswap’s native cryptocurrency UNI risks falling again in the downtrend by another 10 percent as it ended the first governance vote. The members of the UniSwap community claimed that the whales with access to larger quantities of UNI tokens that are unanimously changing the network rules. The accusations followed the launch of the first proposal on the exchange dubbed as “Reduce UNI Governance proposal and Quorum Thresholds” by Dharma.

The Defi trading and the lending platform suggested reducing the current proposals submissions threshold to 3 million UNI 10 million UNI coins. The suggestion entered a controversy right after one of the Uniswap community members David Felton accused Dharma of enjoying too much control over the governance model of the project. Mr. Felton wrote

“Dharma, with its massive voting power of 15 million votes [in one address alone], already presents a threat to Uniswap’s sovereignty without this proposal, which will so powerfully entrench them in Uniswap governance they might as well just outright own the DEX.”

Other observers forwarded the centralization issue by mentioning Gauntlet which is a blockchain simulation platform with access to about 15 million UNI tokens. Some of them launched the campaign to vote against the Dharma proposal altogether. As Chris Blec the founder of Defi watch said:

“43m votes delegated. 30m to Dharma & Gauntlet. D&G proposes lowering the quorum to 30m and vote YES. 13m eligible votes remaining. (You can’t vote if you didn’t delegate before the vote began.) And guess who controls half of the remaining votes?”

The findings lifted the appeal once Uniswap attracted a stronger user base which is decentralization. The big players controlling most of the UNI governance tokens which are partnering between the two whales that could negate the votes of many that will be voting against them. The impact of such centralization could lower the demand for UNI tokens altogether. The fears of centralization are visible for all UNI pairs. The pair UNI/USD dropped by about 20 percent right soon after the exchange landed into the voting controversy. As it did, the pair broke below a crucial support level below the $3.17 and now was targeting the $2.89 with a potential rebound.

The fundamentals showed a further downside correction in the UniSwap markets as it increased the UNI/USD potential to test the $2.4 support level from October.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post