There are many cryptocurrency metrics used to track and compare cryptocurrencies – but which are the most useful ones that can help us see big potential? Moreover, how analysts compare cryptocurrencies and see their potential?

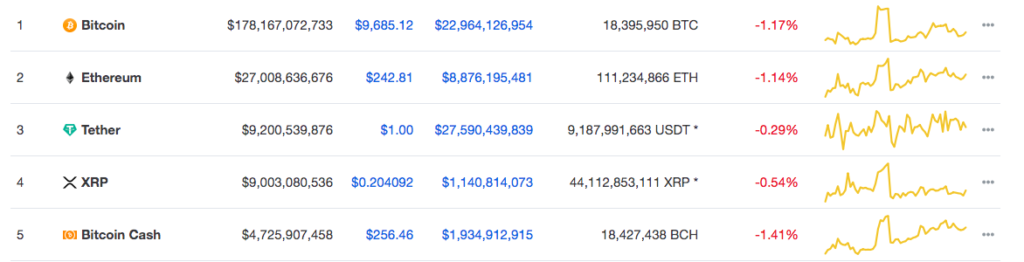

In the latest cryptocurrencies news, we can see that Bitcoin is struggling, with ETH and XRP following the bearish momentum. But if you truly want to know how we do it and how analysts compare cryptocurrencies on a daily level, below we are listing three great ways to do it.

In fact, we are referring to a panel at Messari’s Mainnet event where the CEO of Kaiko, Ambre Soubiran, and the co-founder of Coin Metrics, Nic Carter, spoke about all the ways blockchain data can be useful when comparing digital assets on the market.

Compare Cryptocurrencies By Tracking Their Dispersion

The first way to compare cryptocurrencies is by tracking their dispersion. As Carter said, his preference for doing this was by following various digital asset networks.

“You guys might be expecting me to say realized cap here, but I would actually say something like the dispersion of addresses,” said Carter. “So, the number of addresses with certain thresholds of value in them because that’s a pretty strong, kind of, indication of the growth of the holders of that asset.”

Carter also used the number of addresses holding at least BTC 0.1 on the Bitcoin network as an example data point. He said:

“If you look at the chart on Bitcoin, it looks a little bit like the price chart, actually,. It has these really rapid expansion phases [followed by] slight concentration. But just, generally, the trend is growth, as the user base gets more dispersed.”

Taking A Look At Their Liquidity

Next up was Soubiran who said that it is always useful to look at metrics around usage and velocity. This allows investors to see how money is being moved around on a cryptoasset network and compare cryptocurrencies in an effective way. He said:

“Going back to my bread and butter, I’m completely obsessed with order book metrics and how you can derive order book data to have more liquidity-related insights on the market.

And so, everything about slippage, market depth, how quickly market depth depletes when you have large market moves—there are so many things that you can learn from order book data that goes way beyond just pure price information. It really gives a lot around market microstructure and how stable the market actually is.”

Compare Cryptocurrencies Based On Customer Data

While Carter and Soubiran talked about the metrics above, Balter agreed and pointed that customer data is also important when looking at the networks. He said:

“If you might look a few years out, an investable asset might be one that has real customer metrics, things that you might understand maybe as you’re even investing in equities today: user growth, retention, [customer acquisition cost], [and loan-to-value],” he said.

We hope that this information by experts helped you realize the great ways you can track and compare cryptocurrencies. One of the best ways to start is checking our Price Indexes – and the Bitcoin (BTC) Price chart as the first on your list.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post