Grayscale added LINK to its portfolio as the institutional demand rises which could eventually boost the LINK price so let’s read more in our latest Chainlink news today.

The crypto fund Grayscale added LINK to its portfolio as the move came a few weeks after the company launched a new trust fund and offered institutional investors more exposure to the token’s movement in price, according to the announcement. The world’s largest digital currency asset manager said that they have been selling the Fund Components in proportion to their respective weightings and even used the cash proceeds to purchase LINK accordingly to the Fund’s construction criteria.

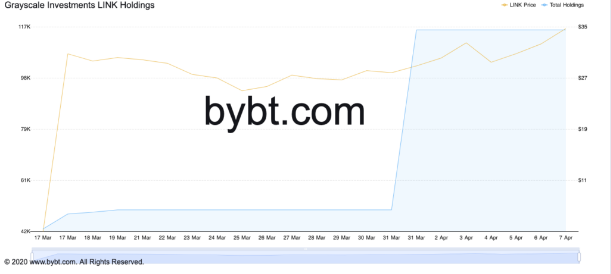

The data from ByBt shows that Grayscale raked about 66,000 LINK in the past week which was worth more than $2 million. The company holds about 115,600 LINK which represents 0.90% of all the digital assets in the fund. LINK’s market value increased by 20% since the start of the month as institutional demand picks up and cuts through the significant resistance barriers ahead of it.

Based on the on-chain analytics tool IntoTheBlock’s GIOM model, Chainlink seems to have created a price floor between $25.50 and $28.75 with more than 52,000 addresses buying up 52.20 million coins. The massive demand wall will give strong support and will absorb the downward pressure behind the cryptocurrency. The cohorts revealed out of all LINK addresses that about 91.30% are in the “money” and 0.11% are out.

The figures indicate that the investors behind the decentralized oracle token are really confident about the next price action with a sudden spike in profit-taking could see LINK fall If there’s no supply wall ahead of it.

Also as recently reported, Chainlink can help secure Polkadot’s environment now as the platform integrated with Chainlink and incorporated its oracle services into the multi-chain environment. The different teams that are building on Polkadot will be able to count on the “flexible and reliable” solution to feeding the parachains with more information. The price Feeds were enabled as a Substrate Oracle pallet that can be accessed by any other pallet that is integrated into the parachain.

The standard will be worked to bring the usage of data feeds in all Polkadot parachains and the focus will bring an easy integration to leverage Chainlink’s features which include decentralized infrastructure, secure nodes, cost efficiency, and high-quality data. The apps connecting to the LINK pallet will be able to add a collection of on-chain data sets for the crypto assets, commodities, and FX Rates.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post