LINK leaves the top 10 altcoin position silently will still remaining quiet about the controversial campaign by Zeus Capital which is still calling people to join the class-action lawsuit against the project. LINK has been declining since the campaign started as Zeus claimed they are shoring the tokens so let’s read more in the chainlink news today.

As a reminder, Zeus Capital allegedly impersonated a London-based brokerage and claimed that LINK operators are using a classic pump and dump schemes such as Trading on inside information while warning that a price crash is imminent. The report also claimed that LINK will be classified as a security and will leave the investors at risk from dealing with unregistered securities and court orders for the disgorgement of proceeds.

Lost money from the Russian pump-and-dump fraud $LINK?

Don't like Sergey buying $6 million dollar condos on Upper East Side with LINK marines' money?

Join the class-action lawsuit, tell us your story.

Contact details are on https://t.co/LK5J2PsMR8 pic.twitter.com/mdNxZQo9tc— Zeus Capital (@ZeusCapitalLLP) July 27, 2020

The twitter account which is mostly focused on Chainlink tends to highlight that this is a “Russian pump-and-dump” scheme and while some debunked this thesis within the crypto community, the project didn’t comment on these accusations and still hasn’t responded to requests for comments. Zeus Capital also doesn’t reply to requests for comments on the lawsuit yet. However, a partner from Zeus Capital Linda Stone, claimed that chainlink “caught our attention as their public announcements intensified and LINK price skyrocketed.”

They claim that no contact was made with Chainlink and made their reports based on publicly available information and discussions with clients. As for the email addresses to which the report was sent, Stone claimed that they purchased the info from a data provider which they cannot disclose at this point. Stone said that the company was created in 2019 and that the team consists of investment professionals with huge capital markets expertise and knowledge. The team prefers to stay anonymous currently:

“Our personnel has received numerous personal threat as a result of their previous investigations.”

The company said that they cannot disclose the list of investments as well:

“We do hold a short position in LINK. Generally, we have a short/long mandate which utilizes both quantitative strategies and fundamental/activist investments.”

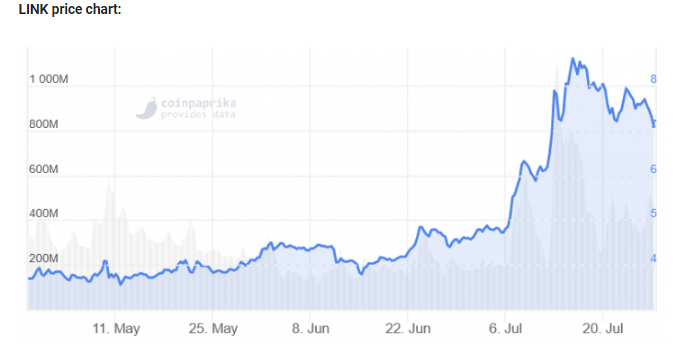

In the meantime, LINK’s price has dropped more than 20% since July 15 when the report came out. It is now trading at $6.93, dropping 7% in the past 24 hours.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post