Over the past few months, we can see record surges in BTC options market volume, signalling greater interest and participation from institutional investors on the market. This is a good sign and as we can see from the latest Bitcoin news, organizations are stepping in the world of crypto.

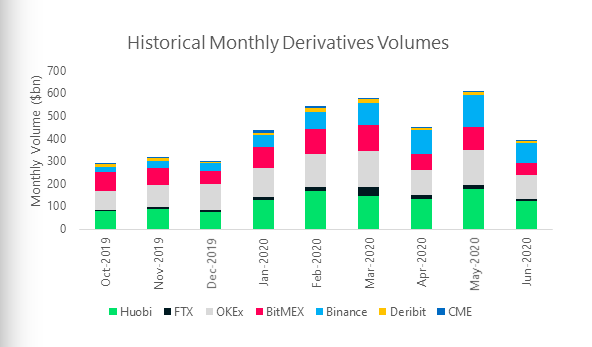

The report was published on July 6 by CryptoCompare and closely analyzes the monthly trends in the crypto exchange marketplace. As such, it found that crypto derivatives volumes started tapering off after peaking this May. For those of you who don’t follow them, the crypto derivatives volumes dropped 35.7% in June to a new volume of $393 billion.

The overall trend observed in the spot markets can also be explained by the lack of volatility that is currently seen in Bitcoin and other crypto assets on the total market cap. There are, of course, exceptions such as DeFi tokens, which outperformed Bitcoin (BTC) considerably in the last month according to the latest crypto news updates.

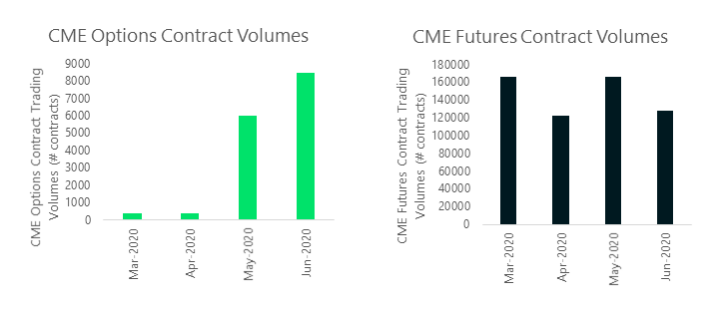

Despite the entire drop in overall volumes for the derivatives markets, the regulated options seem to be rising in terms of popularity. June reports show that the total volume for Bitcoin options on the Chicago Mercantile Exchange (CME) rose by 41%, reaching another all-time high with 8,44 contracts being traded.

The record surges in BTC options market lead many to believe that institutional money have started flowing. Meanwhile, the BTC futures traded on CME decreased by 23% in June which was still their second biggest month in 2020. Below is a visualization of both.

While all of these are great signs for people waiting institutions to step in the crypto industry and become the catalyst we wanted to see which brings BTC and other coins to new heights, there are still some other factors pointing to this change.

The trends are already observed in funds such as the Grayscale Bitcoin fund (GBTC) which boast an institutional investor demographic of more than 80% and is currently managing $4.1 billion dollars worth of digital assets. The CEO at GBTC’s Digital Currency Group, Barry Silbert, tweeted that the fund has recently gone through the biggest raise yet but no details are yet known.

Record fundraising day today for @GrayscaleInvest

— Barry Silbert (@barrysilbert) June 23, 2020

As institutions hop on the train called Bitcoin, it is possible that trends like this with record surges in BTC options market volumes continue showing up, spurring the interest for crypto.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post