The historically low volatility proves that the Bitcoin liquidity will slide again, as the consolidation channel that formed in May was narrowing down ever since. In the upcoming Bitcoin news today, we take a close look at the analysis.

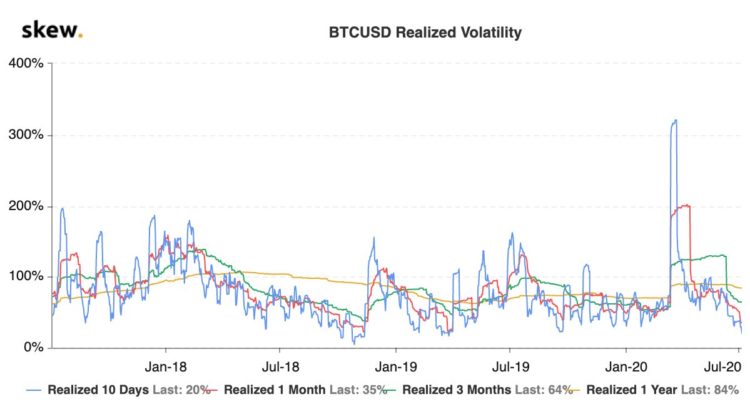

The cryptocurrency is doing some sideways trading between $9000 and $9300, facing a huge resistance at the upper boundary of this range. Looking it from a fundamental perspective, the benchmark cryptocurrency has been looking at a stagnating market which is driven mainly by the sharp decline in liquidity. This trend will persist in the near-term as the data shows that Bitcoin’s 10-day realized volatility is now standing at 20%. The last time this metric was reached, was just before a huge sell-off in November 2018.

The combination of low liquidity with low volatility could lay the groundwork for the digital asset to post some huge movements in the upcoming weeks. Bitcoin was unable to incur any decisive momentum over the past few days, even weeks, making it unable to post huge movements in the upcoming period. The past weekend, sellers tried to push the digital asset down to the lows of $8,900 while form here, the buyers gathered the selling pressure and led it back into its long-held trading range between $9000 and $9300.

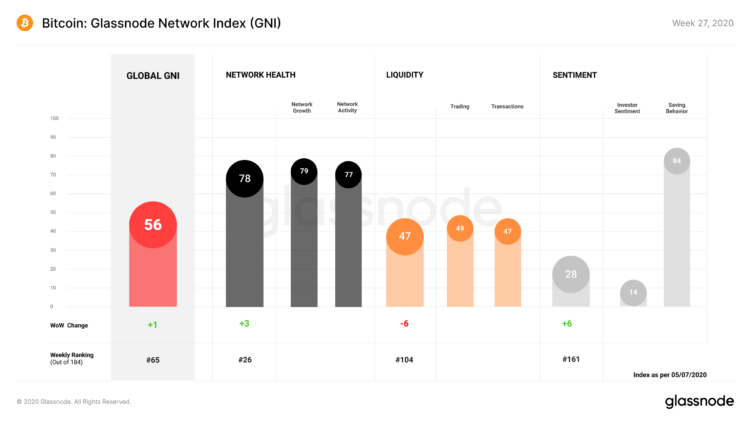

Over the past 24-hours, buyers were trying to break the massive resistance that is standing around $9300 but failed to do so. One consequence of this trend was the decline in Bitcoin’s liquidity. According to a recent report from the analytics platform Glassnode, the Historically low liquidity was the one metric within the network index that declined in value over the past week. The report shows that transactional liquidity and trading declined both over the past week:

“Liquidity dropped by 6 points over the past week, losing ground in terms of both trading and transaction liquidity as exchange deposits and on-chain transactions decreased.”

The report also added that the cryptocurrency is still strong as its network health and investor sentiment both increased at the same time. The historically low volatility seems to show that a huge movement is just around the corner. According to the data from Skew, Bitcoin’s 10-day realized volatility declined to levels that were not seen since 2018:

“Bitcoin ten days realized volatility = 20%. Last time we reached that level, we had the great sell-off of November 2018 shortly after.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post