The BTC funding rates skyrocket as the consolidation continues and made BTC see some choppy price action as of late with the cryptocurrency ranging between the lower and upper $30,000 region. In today’s Bitcoin news, we are taking a closer look at the price analysis.

BTC was able to fund some strong support in the lower part o the range with the sellers trying to break it on a few occasions but to no avail. The cryptocurrency was seeing some large bouts of buying activity to counter the selling pressure which seems to be coming from the whales on Binance and coinbase. As soon as the bears lift the selling obstacles or they don’t have any more coins to sell, BTC will start flying higher.

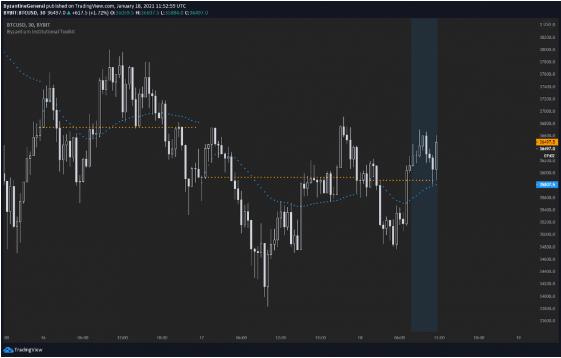

One trader noted that although the crypto market is in a position for another upside, the higher BTC funding rates are still a potential catalyst for the long-squeeze. Bitcoin saw some positive price action over the morning and with the cryptocurrency rallying higher after the overnight selloff, it sent the cryptocurrency to new lows of $34,800. The buying pressure proved to be significant here and helped spark a rebound that was unfolding at the moment. BTC’s price hit $37,500 before facing a strong influx of buying pressure which slowed the increase.

It is still looking strong but there’s a huge chance that they will see more near-term upsides once the $37,000 level is flipped to support. One analyst cautioned against getting excited and he noted that the high funding rates are showing that there could be a short-squeeze in the BTC future. At the time of writing, BTC is trading up under 3% with a current price of $36,900 which marks a rally from the overnight lows of below $35,000 that were set a few hours ago.

Where will the crypto trend in the mid-term will depend on the reaction of the $37,000 level which is a resistance for BTC and could make flipping it into support very important. One analyst explained in a tweet that the short-term upside potential could be hampered by the high funding rates for the leveraged positions. This could indicate that being long is a crowded trade and the long-squeeze is imminent:

“TWAPs & daily opens seem to be really important these days. Funding is getting pretty high again though, so I don’t think there’s a whole lot of room for further upside.”

The upcoming few days will shed some more light on the outlook that BTC has with the reaction to $37,000 and $40,000 setting the tone for the mid-term trend.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post