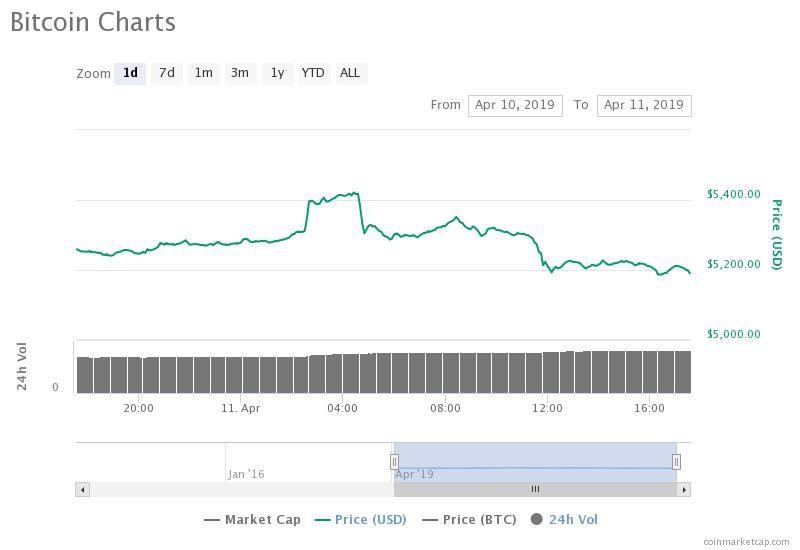

Following the recent 2019 high for the number one cryptocurrency, Bitcoin dropped by 4 percent and in the latest cryptocurrency news today we find out why.

Bitcoin reached $5,540 only 12 hours ago but it dropped soon after despite the increased demand for the currency from investors. Also, the Bitcoin Investment Trust premium which is a cryptocurrency investment company that has about $1.2 billion under management, increased by 10 percent.

According to the price analysis, over the past 14 days, when bitcoin started the 20 percent rally, it showed slight retracements from 1 to 5 percent range. It started the rally at $4,200 and reached $5,000. On April 4th, Bitcoin reached $5,261 but it soon fell down by more than 7 percent.

The price analysis shows that Bitcoin is likely facing some issues after starting the upside movement because of the resistance levels hovering above the currency above the $5,000 region.

Technical Analyst Luke Martin believes that the $5,500 price point is a relatively strong resistance level and that the asset should be able to recover above $6,000. He noted:

“For the first time since $1,000 BTC breakout on Apr 1st, [the bitcoin] price is reaching an area that I expect to act as resistance. It’s the only area price paused at after the dump from $6,000.”

Since the price of BTC dropped after reaching the resistance level at $5,500 it seems like the asset will need strong catalysts to boost it past the level and reach to the $6,000 region. In the short-term, if institutional investors decide to pour their capital in bitcoin, the demand for Bitcoin will go up and so will its price.

Also, in the medium-term the recent developments in the crypto industry such as Coinbase issuing its crypto debit cards, could further raise the confidence for the crypto sector from investors.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post