BTC is overpriced and is primed to face “modest headwinds” in the short-terms according to the analysis from JPMorgan Chase as they based their analysis on the traders which have made in the futures markets with the estimates of Bitcoin’s intrinsic value so let’s read more in our latest Bitcoin news.

Financial strategist at JP Morgan projected the outlook for Bitcoin’s price in the short-term and according to the analysis, Bitcoin is overpriced and will trend at 13% over its intrinsic value. They based the analysis on positioning indicators that were derived from bets that were made by traders n the futures markets. According to the reports from mainstream media outlets, JPMorgan strategists created a near-term bearish case for BTC and Nikolaos Panigirtzoglou and his fellow colleagues commented that there still seems to be an overhang of the net long positions.

CME #Bitcoin Futures

Oct. 13, 2020Another slow day. Apparently traders aren't convinced that the time is ripe for a breakout.

Keep an eye on it 👇 pic.twitter.com/zh54zyNYEy

— ecoinometrics (@ecoinometrics) October 14, 2020

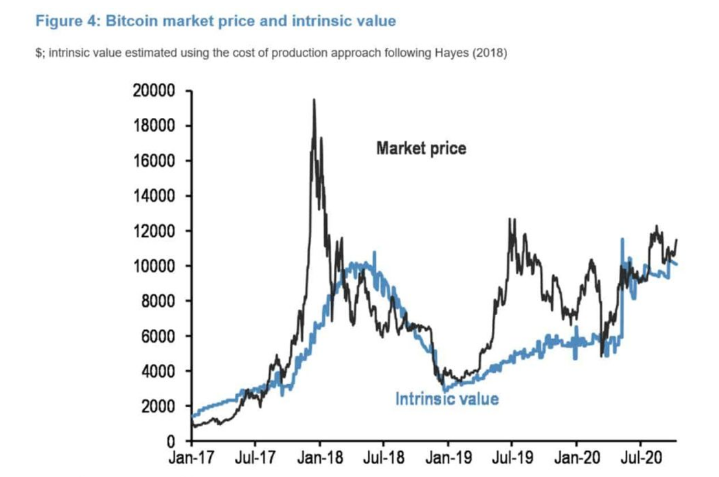

BTC is overpriced and lost a lot of the excessive gains in September as Nikolas and the other analysts commented. The cryptocurrency is still priced at 13 percent higher than its estimated intrinsic value which according to JPMorgan, will work out a little below $10,000. The strategists from the bank arrived at the intrinsic value figure for BTC by simply considering it as a commodity and going through the bare minimum cost to produce or to mine cryptocurrency. according to JP Morgan analysis, bitcoin is experiencing strong demand for the corporate entities which is especially to the reputed public companies like Square and the tech company MicroStrategy infused the major reserve funds in Bitcoin.

Econometrics, the Twitter-based daily BTC data, shared more information about the price movement from the traders’ behavior in the CME Bitcoin futures market. the people are taking it slowly according to the handle and are skeptical about a possible breakout. With the in-depth look into the CME BTC futures technical outlook, it became clear that BTC could move and fill the gap at $11,095 as it was pointed out by the TradingView charts by WyckoffMode.

The Relative Strength indicator for the BTC price is on the way to drop below 50 according to the trader. He confirmed that there are increased odds for the downward price action which means Bitcoin will be prone to drop and fill the CME futures gap at $11,095.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post