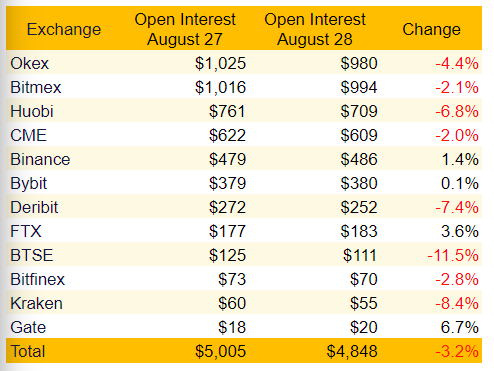

The expiry of the Bitcoin futures today was lackluster, both in terms of its price impact and its volume, which sets the next BTC target at $12,000 according to some analysts. Meanwhile, the crypto news today also show that open interest dropped by a mere $157 million and barely moved from the $5 billion mark.

Among the cryptoverse, analysts are saying that the most recent CME Bitcoin futures expiry was quite irrelevant. In fact, around $125 million worth of August contracts were set to liquidate today but preliminary data indicates that less than $40 million were not rolled over for the upcoming months.

As the chart from above shows, the total open interest change over the past 24 hours was irrelevant for a lot of things. However, the data above includes inverse swaps (perpetual) as well as the remaining calendar months.

Nonetheless, this is very opposite from the July expiry which was a major event in the Bitcoin news, when $500 million worth of futures contracts were liquidated. The main reason behind the traders and their indifference to today’s expiry seems to be the failure to establish any support levels above $11,200 in the past few weeks.

Our expert analysts think that the next BTC target is set for $12,000 after this move, mostly because some macro factors hint at a positive medium-term to long-term price cycle. In the near term, momentum may fade and a consolidation phase will happen.

Despite the loss of momentum for the dominant coin, the next BTC target is set by many investors who are covering the futures markets. The absence of volume and stability of futures open interest means that some bets have already been placed. A bearish scenario shows that the total open interest more than doubled throughout 2020. The current mark of $4.9 billion is only $800 million shy of the high achieved on August 17, 2020.

Tight intraday moves between gold and Bitcoin last for a couple of days sometimes. The short-term correlation now should not be seen as a sign of Bitcoin becoming a reserve asset – instead, it should be looked as a reminder that the crypto markets are impacted by the same external events that guide traditional markets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post