Cardano hits macro resistance but the on-chain analysis shows that ADA is mounting strength as we are reading further in the ADA news.

ADA saw a sharp price decline today as the entire crypto market shows signs of weakness. ADA’s weakness is being explained by the high-time frame resistance level that is pushing it up again and analysts do believe that this could cause it to see some notable losses in the upcoming weeks and months. Other analysts believe that its the heaviest near-term resistance doesn’t quite exist until another higher level. According to the data, Cardano could push higher before the intense upwards momentum stalls, as it can be seen from the charts.

Cardano hits macro resistance level and is trading down by 4 percent at a current price of $0.085. the decline also caused ADA to shed three percent of the value against Bitcoin. The root of the weakness seems to be a result of the turbulence seen by the aggregated market as Bitcoin faced a huge rejection at the $10,000 level that led it back into the $9,000 region. It is also important to note that Cardano has been caught up in the macro uptrend over the past few weeks and rallied from $0.04 to the recent high of $0.09.

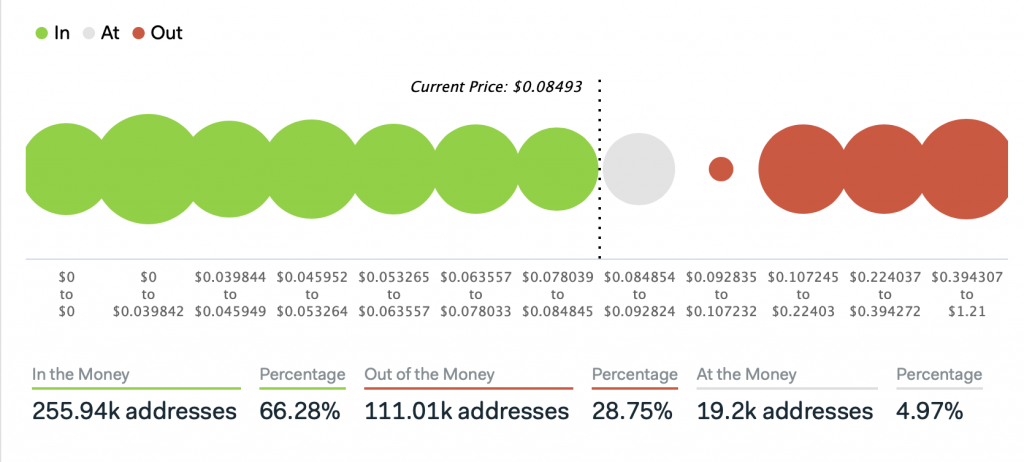

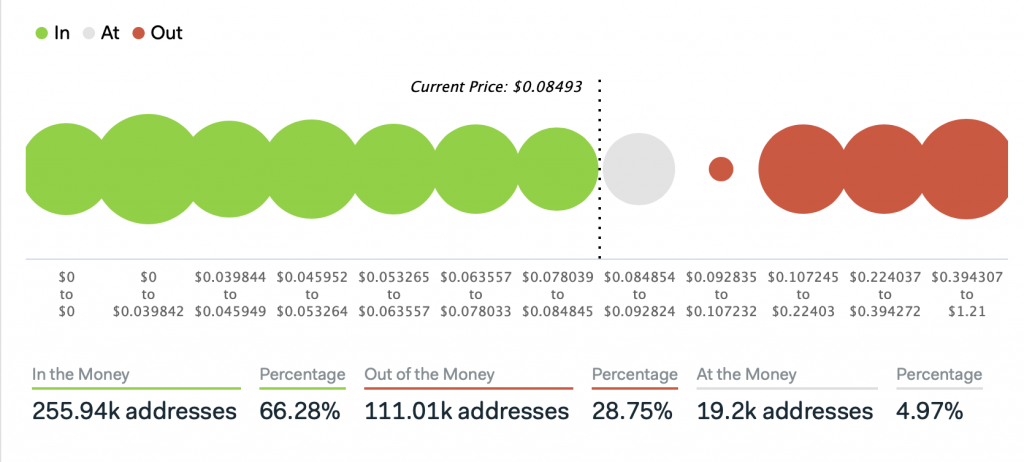

The intense uptrend allowed ADA to outperform the aggregated market but it is still in a precarious mid-term position as it is trading beneath the massive high-time frame resistance. One trader under the name TraderXO offered a chart showing how important this level is and pointed to the overextended RSI. Despite the strength of the HTF resistance that can be seen on the ADA/BTC chart, the on-chain analysis from In/Out of the Money indicator of the IntoTheblock analytics firm, shows that there’s little resistance until ADA reaches $0.11.

While looking into it and looking towards the same indicator around the current price level of Cardano, it does appear that it faces some major short-term resistance between $0.085 and $0.092 price level. Once ADA surpasses this important resistance, it is only an open road for the cryptocurrency from thereon. Because ADA doesn’t appear to be correlated with Bitcoin that closely, at present time it is possible to see a reaction in the near-term which could determine which direction ADA will take into the trends in the following weeks and months.

Cardano hits macro resistance but the on-chain analysis shows that ADA is mounting strength as we are reading further in the ADA news.

ADA saw a sharp price decline today as the entire crypto market shows signs of weakness. ADA’s weakness is being explained by the high-time frame resistance level that is pushing it up again and analysts do believe that this could cause it to see some notable losses in the upcoming weeks and months. Other analysts believe that its the heaviest near-term resistance doesn’t quite exist until another higher level. According to the data, Cardano could push higher before the intense upwards momentum stalls, as it can be seen from the charts.

Cardano hits macro resistance level and is trading down by 4 percent at a current price of $0.085. the decline also caused ADA to shed three percent of the value against Bitcoin. The root of the weakness seems to be a result of the turbulence seen by the aggregated market as Bitcoin faced a huge rejection at the $10,000 level that led it back into the $9,000 region. It is also important to note that Cardano has been caught up in the macro uptrend over the past few weeks and rallied from $0.04 to the recent high of $0.09.

The intense uptrend allowed ADA to outperform the aggregated market but it is still in a precarious mid-term position as it is trading beneath the massive high-time frame resistance. One trader under the name TraderXO offered a chart showing how important this level is and pointed to the overextended RSI. Despite the strength of the HTF resistance that can be seen on the ADA/BTC chart, the on-chain analysis from In/Out of the Money indicator of the IntoTheblock analytics firm, shows that there’s little resistance until ADA reaches $0.11.

While looking into it and looking towards the same indicator around the current price level of Cardano, it does appear that it faces some major short-term resistance between $0.085 and $0.092 price level. Once ADA surpasses this important resistance, it is only an open road for the cryptocurrency from thereon. Because ADA doesn’t appear to be correlated with Bitcoin that closely, at present time it is possible to see a reaction in the near-term which could determine which direction ADA will take into the trends in the following weeks and months.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post