A critical ETH pullback offers a long-entry position for sidelined investors as the second-largest cryptocurrency is looking to gain upside momentum after the pullback from last week at $360. In our Ethereum news today, we are looking deeper at the price analysis.

Ethereum is once again trading in positive territory for the month as the bulls are looking to accumulate the cryptocurrency on meaningful price pullbacks. The on-chain data and technical analysis point to a bullish breakout if ETH surpasses the $390 level. The fundamentals around ETH are looking strong ahead of the upcoming ETH 2.0 rollout. The critical ETH pullback will offer long entries for the sidelined investors as ETH staged a notable price pullback alongside Bitcoin over the past week after the largest altcoin failed to break above the critical monthly resistance at $390.

"If Bitcoin is email, a one-trick pony…but obviously revolutionary, Ethereum goes far beyond that, it's more like the internet.

When I think about DeFi, it's obviously revolutionary & could lead to a massive disintermediation of the financial system."

– @ChairmanHeath CFTC

— Ryan Sean Adams – rsa.eth 🏴 (@RyanSAdams) October 15, 2020

Ethereum was mainly weighed down by a negative sentiment surrounding the crypto exchange OKEx which suspended the client withdrawals. The latest price action came at a critical time for Ethereum since a breakout above the $390 level could start a strong bullish tone for the following days and weeks to come. However, the longer ETH struggles to enter the $390 resistance zone, the downside risks could intensify and can cause the cryptocurrency to slip back to the $340 support area.

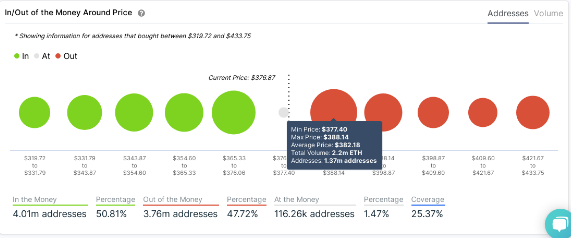

According to the IntoTheBlock’s In/out of the Money Around Price model, 1.37 million addresses purchased 2.2 million ETH at an average price of $382 with a maximum price of $388. This level, therefore, remained a critical area to watch for buying pressure. However, the trading volume has to increase to facilitate the imminent break above the $390 resistance zone since ETH faced a lot of criticism over severe network congestion issues.

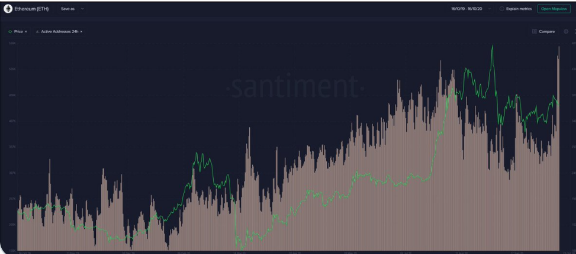

Heath Tarbert, the chairman of the US Commodities and Futures trading commission doubled down on the support for ETH due to the technological advancement along with the bullish commentary of Tarbert which influenced ETH to catalyze a massive price surge in the near-term. Additionally, crypto data provider Santiment tweeted:

“Ethereum is seeing its highest level of unique addresses interacting on its network since May 2018 after a sudden influx beginning yesterday. This coincides with greatly reduced fees, likely a sign that traders are moving funds with less hesitance.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post