Crucial ETH price fractal predicts a surge towards the $430 level as it saw some weak price action over the past few days despite the strength in Bitcoin’s price which allowed it to cling on the $13,000 price ranges. In today’s Ethereum price news, we are reading more on the analysis.

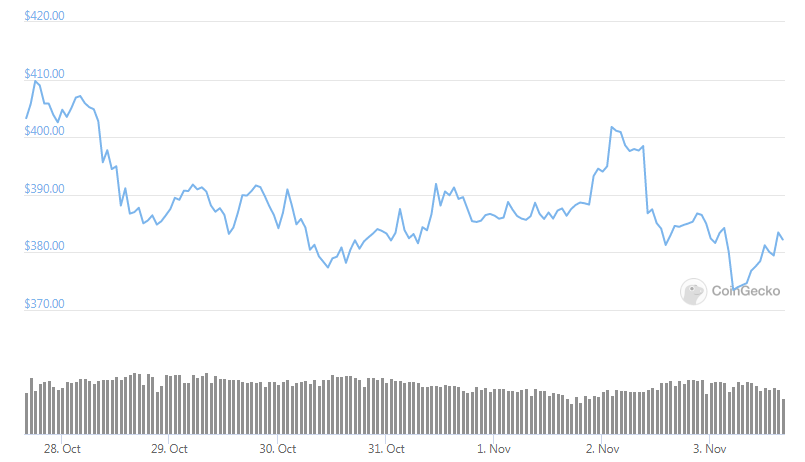

Ethereum is now trading for $383 which is down by nearly 3% in the past 24 hours. This makes it the worst performer in the top 20 by market cap but despite the price action, the analysts remain optimistic about the leading cryptocurrency. The key analysis in the chart is that Ethereum’s price action over the past week looks similar to the one seen in the middle of October during a period of consolidation at $370 with the crucial ETH price fractal forming. This simple fractal analysis shows that the cryptocurrency which could move it towards $430 and beyond in the upcoming days. Both periods outlined in the chart have seen some similar price action suggesting a similar trend will play out again.

Ethereum has fundamental trends showing more growth is on the horizon at least on a longer-term basis. Australia’s central bank for example just announced a new partnership for the central bank digital currencies which will involve Consensys, the well-known Ethereum development studio, and the ETH-based technology:

“The Reserve Bank today announced that it is partnering with Commonwealth Bank, National Australia Bank, Perpetual and ConsenSys Software, a blockchain technology company, on a collaborative project to explore the potential use and implications of a wholesale form of central bank digital currency (CBDC) using distributed ledger technology (DLT)… The project will involve the development of a proof-of-concept (POC) for the issuance of a tokenised form of CBDC that can be used by wholesale market participants for the funding, settlement and repayment of a tokenised syndicated loan on an Ethereum-based DLT platform.”

The Reserve Bank of Australia showed interest in the technology of Ethereum and their decision as echoed by other entities both governmental and corporate. For one, Santander Bank, the prominent Spanish Bank settled a small bond on ETH and many saw it as an important step ahead in the efficiency and transparency of financial applications. This is probably why the ETH decentralized finance space saw such rapid growth over the past few months.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post