The ETH active supply has just hit a 17-month low but will it affect the price? Let’s find out more in the following ethereum price news.

The data fetched by Glassnode shows that there are now over 15.1 million ETH available for accumulation even as the demand for the crypto increased before its awaited protocol migration to proof-of-stake. With its periodic high, the active supply was near 40 million. In retrospect, this metric above outlines the amount of circulating supply last moved between 6 months and 12 months. The dropping figure shows that there is an increase in the amount of “Hodling” behavior among the ETH traders. In the meantime, if the demand for ETH grows higher during the period of dipping, the price will occasionally move north.

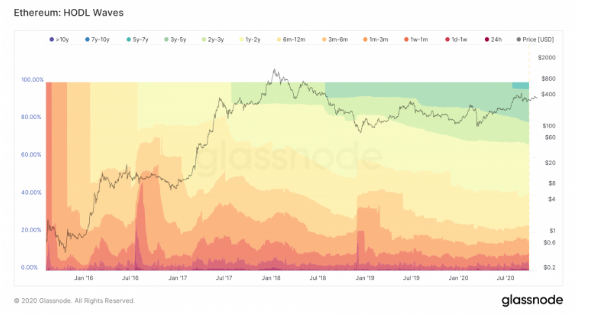

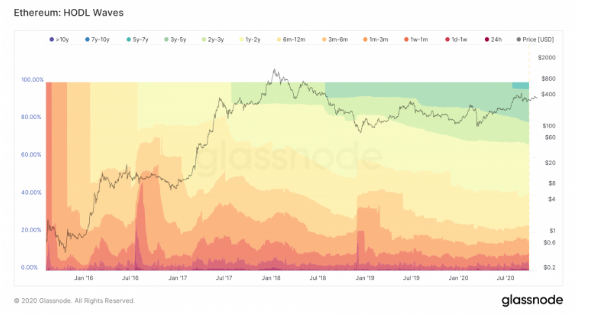

Glassnode fetched the demand-side data from another chart known as HODL Waves. The unique metric reflects the rate at which the traders/ investors are holding Ethereum. The increase in the figure means a dismissive selling sentiment in the long-term and a strong bearish bias as well. Glassnode data suggests that many investors accumulated ETH tokens in 2019 and it amounts to more than half of the cryptocurrency’s existing supply which has not changed hands in the past 12 months. It further pointed to less available stocks in the days which led to ETH proof of stake this year. Anthony Sassano, the co-founder of ETHHub said:

“With the ETH2 phase 0 approach, it’ll be interesting to see how much this percentage comes down by as Ethereum OG’s move their stash into staking. I’m particularly curious to see if any of the coins in the 5+ years category move.”

On the supply side, the prospects of ETH hitting a new yearly peak is much higher. The ETH active supply dropped as more tokens go out of circulation and the demand among the traders/investors grows as they use ETH for staking or hold it as a hedge against inflation. The ETH/USD could rise further. So far, ETH played the narratives in favor of the bulls and the cryptocurrency increased by 328 percent from its mid-March low with the same fundamentals around it could even go further higher into 2021.

The ETH active supply has just hit a 17-month low but will it affect the price? Let’s find out more in the following ethereum price news.

The data fetched by Glassnode shows that there are now over 15.1 million ETH available for accumulation even as the demand for the crypto increased before its awaited protocol migration to proof-of-stake. With its periodic high, the active supply was near 40 million. In retrospect, this metric above outlines the amount of circulating supply last moved between 6 months and 12 months. The dropping figure shows that there is an increase in the amount of “Hodling” behavior among the ETH traders. In the meantime, if the demand for ETH grows higher during the period of dipping, the price will occasionally move north.

Glassnode fetched the demand-side data from another chart known as HODL Waves. The unique metric reflects the rate at which the traders/ investors are holding Ethereum. The increase in the figure means a dismissive selling sentiment in the long-term and a strong bearish bias as well. Glassnode data suggests that many investors accumulated ETH tokens in 2019 and it amounts to more than half of the cryptocurrency’s existing supply which has not changed hands in the past 12 months. It further pointed to less available stocks in the days which led to ETH proof of stake this year. Anthony Sassano, the co-founder of ETHHub said:

“With the ETH2 phase 0 approach, it’ll be interesting to see how much this percentage comes down by as Ethereum OG’s move their stash into staking. I’m particularly curious to see if any of the coins in the 5+ years category move.”

On the supply side, the prospects of ETH hitting a new yearly peak is much higher. The ETH active supply dropped as more tokens go out of circulation and the demand among the traders/investors grows as they use ETH for staking or hold it as a hedge against inflation. The ETH/USD could rise further. So far, ETH played the narratives in favor of the bulls and the cryptocurrency increased by 328 percent from its mid-March low with the same fundamentals around it could even go further higher into 2021.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post