ETH trends favor the bulls as per the on-chain analysis, despite the recent 5% drop from the local highs as we can see in today’s ethereum news.

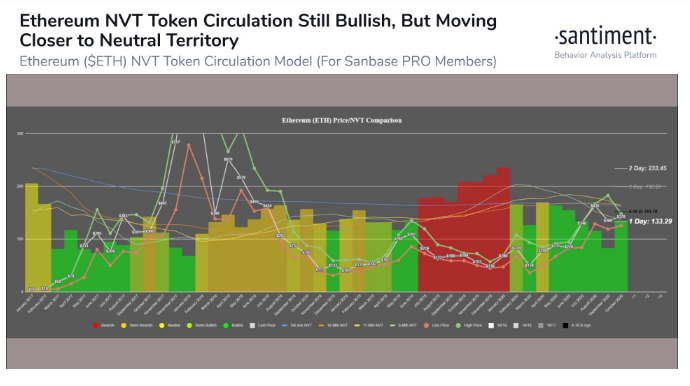

According to the blockchain analytics company Santiment, there was a chart that Ethereum’s NVT is still “bullish” which is the network value to transaction ratio which is seen as the price-to-earnings ratio for blockchain networks but also the data shows the investors are accumulating ETH en-masse with the coins leaving exchanges at a rapid clip. Ethereum went on a strong drop from its weekly high of $385. ETH fell under $370 on Tuesday morning as the capital flooded from the altcoin market back towards BTC which underperformed the altcoins over the past six months. Despite the local drops, analysts remain bullish on Ethereum still.

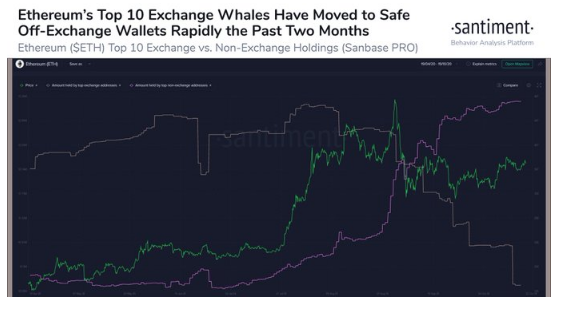

Santiment, the blockchain analytics firm shared a chart where it shows that the ETH trends favor thee bulls as the price action relative to the network value to transaction metrics which are seen as the price-to-earnings ratio for all blockchain networks. On this ratio, Santiment wrote that ETH is still bullish but the trend is getting into neutral territory. The post came after the company noted that the spirit of accumulation which spread among the ETH holders and investors. Santiment also reported that the number of ETH that is held on exchanges dropped dramatically in the past two months:

“$ETH’s top 10 whale exchange addresses have continued swapping their funds to non-exchange wallets, & moving holdings at an impressive rate. The 20.5% decrease in tokens on exchanges the past 2 months indicates price confidence by top #Ethereum holders.”

Not all of the investors in the space believe that Ethereum is in a phase of a Bitcoin market cycle. Kyle Davies who is a co-founder of crypto fund Three Arrows Capital, suggests that bitcoin is outpacing the altcoins dramatically. This came shortly after his business partner Su Zhu made a comment suggesting that this is the first time for BTC to rally while altcoins drop:

“You’re about to find out why all of the rich OG’s hold mostly $BTC.”

You’re about to find out why all of the rich OG’s hold mostly $BTC

— Kyle Davies (@kyled116) October 19, 2020

As recently reported in our ETH news, Since the start of the year, Ethereum’s price gained 170% from below $140 on New Year’s Day to about $380 current levels. There’s no doubt that the main driver of the demand was the DeFi sector which surged by 200% in terms of ETH locked up.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post