Huobi Group is in the latest news around regulation and even politics this time on our DC Forecasts crypto news site. The exchange has recently created a Communist Party committee which makes it the first blockchain-based company to do so in China, according to reports from the South China Morning Post.

What’s interesting is that this community was created through a Huobi subsidiary called Beijing Lianhuo Information Service – registered as a business earlier this year and owned by Li Lin, who is the founder of Huobi.

Lin referred to the launch of the committee as a new milestone for his company, hailing the Communists party for its friendly policies towards the blockchain industry and sharing his excitement by stating:

“Under the cordial care of the Party Working Committee of Haidian, the party branch of the Beijing Lianhuo Information Service Ltd. was gloriously established.”

The laws of the Communist party make it compulsory for enterprises, especially state-owned companies (with at least three Communist Party members as employees) to set up a branch of this party. Huobi, however, is not the first one to set up such a committee – before it we saw similar ones from companies like Tencent and Alibaba Group.

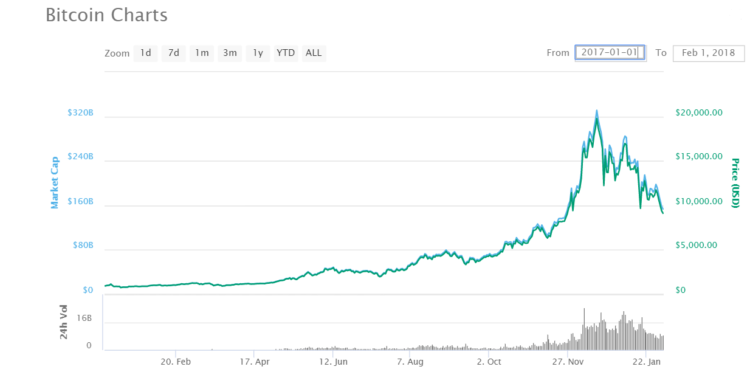

The Chinese government is still friendly to blockchain while ignoring the crypto space and putting a hold of it. As you probably remember, it was the Communist party that put a blanket ban on crypto earlier last year – leading to an exodus of exchanges to the neighbouring conutries.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post