Bitcoin tops $39,000 as the crypto markets lost $100 billion after the recent FED meeting and ETH dropped by more than $200 so let’s read further in our altcoin news and analysis.

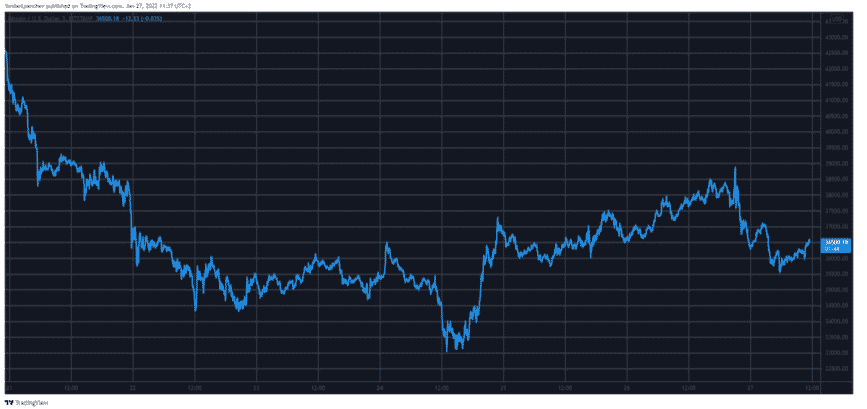

Bitcoin’s run-up was stopped at $39,000 after the Federal Reserve announced it will increase the interest rates in March. The altcoins which were heading north dropped right after Bitcoin. After last week’s bloodbath where the main cryptocurrency dumped by over $10,000 in a few days to a six-month low below $33,000, the market is more positive in the past 72 hours. The asset recovered $4000 in one day before another leg up drove it to around $37,000 and during the trading day, BTC kept on climbing and tapped a six-day high of $39,000.

As Bitcoin tops $39,000, the situation seems bullish but it could be shaky because the Federal Reserve meeting just happened. In it, the central bank said it will be no more changes to the interest rates but they will be increased in March. This caused some insane volatility in the crypto and stock markets and BTC dropped by $3000 in a few hours. It reclaimed $36,000 and it is still 3.5% down on the day. Its market cap is just below $700 billion.

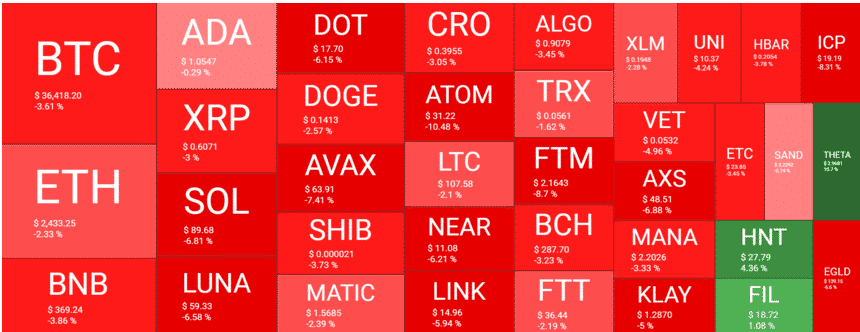

The alternative coins were increasing over the past 72 hours with Ethereum surging past $2600 a few days after being close to dumping below $2000 but the market-wide retracement drove the asset to just over $2400. Binance coin dropped by 4%, Dogecoin dropped by 2.5%, Ripple by 3%, MATIC by 2.5%. more serious losses came from Terra which dropped by 7%, Solana by 7%, Polkadot by 6%, and Avalanche by 7.5%. aside from Theta which is in the green, the mid-cap altcoins are also in the red, Quant dropped by 14%, Waves by 15%, Celsius Network dropped by 11%, and Cosmos by 10%. The entire crypto market slid by over $100 billion after the Federal Reserve meeting.

As we saw yesterday, Bitcoin reentered a key price zone that signaled the start of an end of the bear phases. Charles Edwards who is the founder of crypto investment firm Capriole flagged the BTC network value to transaction ratiometric as it delivered a new oversold signal. Bitcoin’s price losses accelerated over the weekend with the market not being far off the retest of a seminal $30,000 mark before Monday’s Wall street open.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post