The Binance BTC futures markets hit the highest daily volume amongst other platforms and the exchange hosts the highest aggregated daily volume with institutions taking long BTC positions en-masse as we read more in today’s binance news.

With Bitcoin’s latest rally beyond the $13,000 mark, it seems that the next bull market is here and it can be seen that the BTC market was on fire in the past week including the derivatives. The latest data shows that BTC futures markets on Binance BTC futures markets hit the highest volumes among all platforms which comes amid the exchange registering $760 million in open interest. Binance experienced explosive BTC futures market action while Bitcoin rallied beyond $13,000.

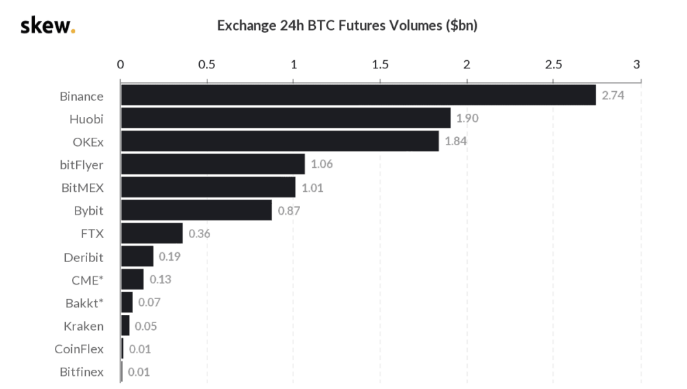

As per the latest data from crypto market analytics company Skew, the exchange hit the highest daily bitcoin futures volume amongst all BTC derivatives trading platforms. This is coming after the Malta-based crypto exchange registered heavy futures trading traffic with the open interest jumping 30 percent to $150 million in just 2 days from October 19 to October 21. Binance’s current OI figure stands at $760 million. Skew’s data shows that binance hosted the highest aggregated daily BTC futures volume and the figure hit $32 billion out of which Binance’s share was $8.3 billion. Binance still has the highest aggregated futures volume.

With Bitcoin’s correction, traders using other platforms are interested in BTC futures and SKEW’s observations show that there was a 54% increase in the daily futures and swap volumes on Huobi:

“#bitcoin in focus, volume market share is increasing pic.twitter.com/ai8T97qfXp

— skew (@skewdotcom) October 20, 2020”

Compared to Bitcoin, only ETH experienced about 30% surge in volume and that’s not all. BTC futures open interest on institutional platforms like CME increased to $784 million which added another 1500 contracts to the pool. Skew did another inspection of the spike of BTC futures open interest on CME and the company concluded that bets are mainly coming from institutions and hedge funds while the former is more optimistic about the price rallying further in the near-term as opposed form the funds that recorded short bets on Bitcoin:

New CME Commitment Of Trader report just came in for BTC Futures:

📉HFs all-time short

📈 Institutions all-time long

❓ Who's wrong? pic.twitter.com/EAHrZnDKdF

— skew (@skewdotcom) October 17, 2020

As recently reported, There’s 7% chance for another bitcoin increase by the end of the year according to the data from Skew. Skew reported that Bitcoin options were moving in favor of higher prices in 2020. At press time, the chance of Bitcoin’s BTC/USD pair being $20,000 or higher by the end of the year, is now at 7% with 11% for $18,000.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post