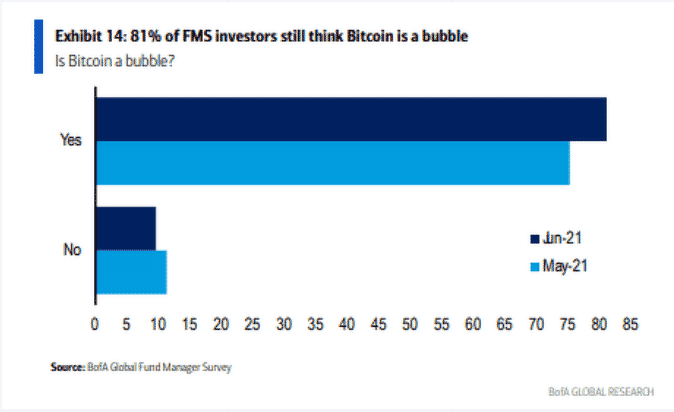

80% of fund managers believe BTC is a bubble according to a new Bank of America survey as we are reading more in our latest Bitcoin news today.

The Bank of America survey shows that the participation from over 200 fund managers with over $650 billion in assets under management and only four in five or 80% of fund managers believe that BTC is a bubble. In addition, the survey found that being long commodities are the most crowded trade with the long BTC coming in second place. Commodities are raw products like gold, silver oil, and lumber. Precious metals are thought to be an effective hedge against inflation and become a growing fear of late. The bank surveyed a total of 224 fund managers with over $650 billion in assets under management but not everyone is convinced by the collective skepticism on show. Jason Deane who is an analyst at Quantum Economics said:

“This survey demonstrates that a lack of understanding of what problems Bitcoin solves is still prevalent in certain sectors – it is still seen as just another asset to trade by some at this time.”

He added that the fundamentals support the position that BTC is poised for a huge price appreciation in the future. The Bank of America survey came amidst the rollercoaster ride for the BTC price. BTC is priced at about $40,000 BTC which increased by 20% during the past week but saw a 14% decline over the past month. At its lowest point in the past 30 days, BTC dropped to a price of $31,000. Beyond the BTC price volatility, the leading cryptocurrency came under more regulatory scrutiny as well.

The IRS Cyber Crimes Unit member Chris Janczewski explained that the agency is watching closing over-the-counter chats on Telegram as a means for criminals to move dirty funds. Last week, the international monetary fund trashed El Salvador’s legal tender project and said the move raised a number of macroeconomic and legal issues. Last week, Tesla’s CEO Elon Musk said that Tesla will start accepting BTC as payment once again if the miners commit to 50% clean energy and his announcement in the past statements about the current state of the sector. When Tesla stopped accepting Bitcoin, Elon Musk’s tweets credited with contributing to BTC price collapse.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post