A record $1 billion BTC futures liquidation has just sunk the markets after the hubris over the weekend while the market continues correcting so let’s take a closer look at today’s Bitcoin news.

The BTC futures markets took quite the beating overnight as the liquidations of futures contracts surpassed $1 billion with the market sentiment remaining neutral while the next cycle begins. If you believed that the market bloodbath was done, well, we have some bad news. The crypto pullback continued overnight and Bitcoin got down by 4.5% over the past day according to the data from Nomics and it is racking up another day of losses.

$1.12 billion worth of longs liquidated in the past hour

Chart: @bybt_com pic.twitter.com/n5OK9DP4Sx

— Bloqport (@Bloqport) March 15, 2021

From the high of $61,500, BTC traded as low as $53,000 in the past 24hours which represents more than a 10% slide. For the futures markets, the situation was even worse. According to Glassnode’s co-founders Jan & Yann there were $500 million liquidations of BTC long-positions bets that the price will go up in one hour. This is the most that it has ever been liquidated according to Glassnode as the founders believe this happened due to losses to excess greed in the system.

Others pointed out that the losses were far greater. Exchange data company byBit reported that the losses were north of $1 billion and this is a record $1 billion BTC liquidation which will have an impact on market sentiments as per the Fear and Greed Index. During the last bull run, the sentiment was in the 90s which suggests that greed was driving the prices up. This month’s sentiment was back into the 70s suggesting an exuberance of February cooling off.

In the last hour alone, nearly $500M in #Bitcoin Longs got liquidated, this is a historic ATH.

There is excess greed in the system, with 60% of contracts levered 20x or more.

Long liquidations are an artifact of the current bull market. pic.twitter.com/n9NciJcS62

— Jan & Yann (@Negentropic_) March 15, 2021

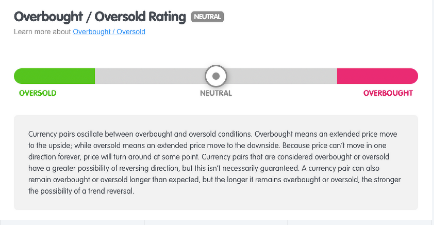

Taking a closer look to the other market measurements on Market Milk, the sentiment pulled back into neutral and this suggests that the investors are waiting out for the turbulence to be over. If we take a look at Wall Street, we can see that the Dow Jones increased by over 100 points and the S&P 500 index hit new highs. Goldman Sachs projected the fiscal resue package and estimated a gross domestic product expansion of 6% in the first quarter. FED’s chair Jerome Powell is due to give a statement this week as he hinted that the central bank is becoming concerned about moves on the bond market and a chance for the economy to overheat.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post