The average BTC transaction fees hit the lowest levels since the start of 2021 and all thanks to the latest restrictions on BTC mining in China with fewer computers competing for the blocks so let’s read more in our latest bitcoin news.

The average BTC transaction fees hit the lowest level since January of about $7 which is the lowest since January 1 as per the data from BitInfoCharts. The average BTC transaction fees dropped to new lows of $7 as per the data from the blockchain analytics site bitInfoCharts. The BTC blockchain charges a fee each time a transaction is conducted and distributes the proceeds to the miners. The fees rise when the demand for processing transactions outstrips the miners’ supply and in April we saw the average fees hitting a record high of $62.8 per transaction.

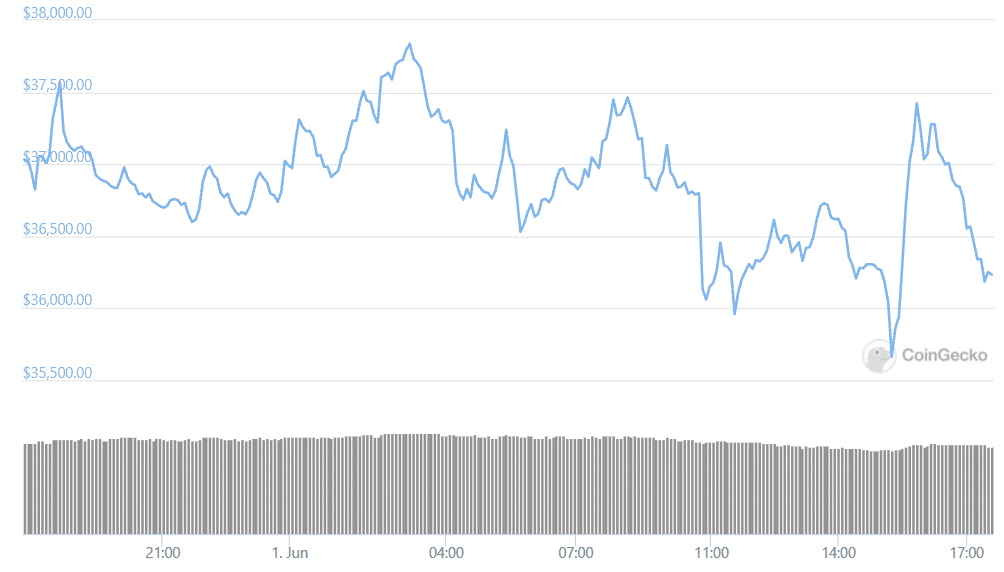

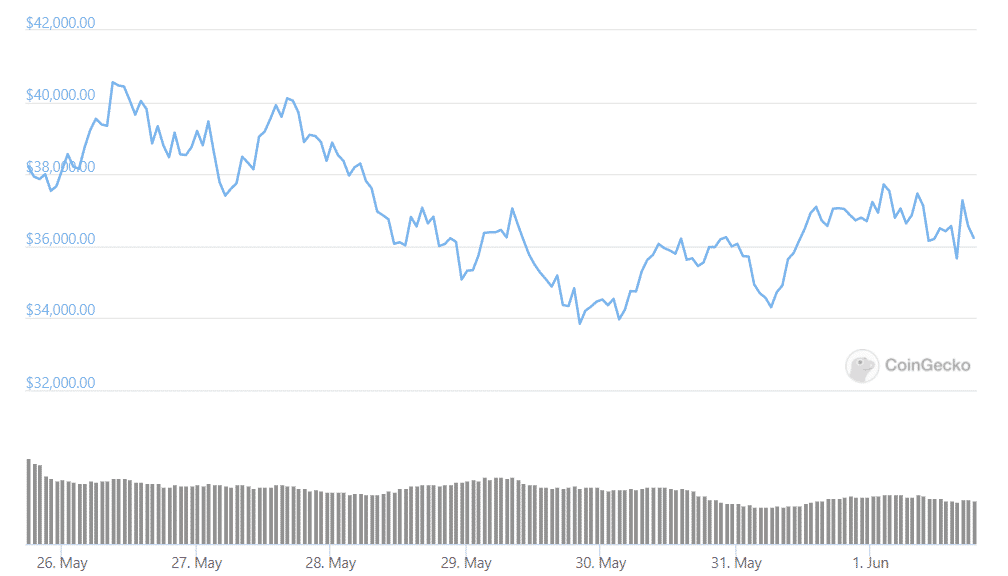

The fees fall when the mining supply outstrips the demand and the drop in fees suggests Bitcoiners are not as interested in making transactions as they were a few months ago. This could have something to do with the recent market crash which sent the price of BTC Down from $60,000 to $36,000 in a few weeks. BTC miners are also not really interested in processing transactions as the mining difficulty that is needed to validate BTC transactions, dropped by 16% on Sunday which was the sharpest drop in over a year. BTC mining became much easier when the overall hash power backing the blockchain declines.

ETH fees are also down thanks to the market cool-off and the global crypto market cap dropped from the peak of $2 trillion last month to the current level of $1.6 trillion according to CoinGecko. The lower prices, hash power, and fees came after a government crackdown on BTC mining in China where most of the miners are located and exchanges Okex and Huobi already started limiting transactions so officials in Inner Mongolia considered banning BTC outright.

As recently reported, BTC crashed by around 44% from its ATH of $64,899 signaling an end to the second biggest bull run that started in March 2020. Most analysts including the ones from BiotechValley Insights see the terrible technicals on the BTC market, noting that the flagship cryptocurrency could extend the ongoing decline until $20K. Glassnode Insights newsletter issued by Glassnode anticipated a BTC price recovery in the sessions ahead based on the indicators that serve as a metric to gauge institutional interest in the crypto.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post