Bitcoin returned to $37K but the price could still go lower and traders demand a $40,000 reclaim for BTC to start a bull run so let’s read more in today’s latest Bitcoin news.

Bitcoin returned to $37K when the Wall Street traders opened up and watched for a new resistance retest with the coin evading the major resistance test. The data shows that the BTC/USD pair is returning to form a new high after a new dip to $36,175 on Bitstamp. As a part of the range-bound behavior, the hopes were held high that the momentum will continue to challenge the resistance levels closer to $40,000 whether or not the outcome will be a fresh correction. The trader Crypto Ed said:

“The bearish scenario seems most likely, which is exactly the reason why I think we’ll see a surprising move. Only after a convincing reclaim of $40K I’ll be full bull.”

#BTC has re-entered the $28000-$38000 consolidation range

BTC last consolidated in this range in Q1 and Q2 of 2021

Naturally, on this latest recovery, the Range High (red) will be the main resistance to beat to confirm further upside$BTC #Crypto #Bitcoin pic.twitter.com/aojF2Zcm0y

— Rekt Capital (@rektcapital) January 25, 2022

Fellow trader Anbessa reiterated the demands for $38,500 to hold and proclaim the corrective phase as complete for BTC. The low funding rates are combined with an improving scenario acorss the derivative market which is something that can spark an upwards trend. Rekt Capital outlined the area for BTC to reclaim to rekindle the bullishness on longer weekly timeframes and this will come in the form of $39,600 as a weekly closing price. Crypto Ed was not alone in his feeling of foreboding in a possible fresh increase. Despite taking liquidity in the dip below $33,000 earlier this week, BTC has not convinced everyone that the floor is here. Twitter analyst TXMC Trades concluded that the BTC/USD pair still has to go lower from this spot and history supports this theory. He argued:

“It seems wrong that BTC would bleed straight down from the ATH without a relief rally, only to have the reversal be front-run without properly testing the range low. Similar vibes to April 2018 where the $6K bounce was front-run, but ultimately collapsed. Just a gut feel.”

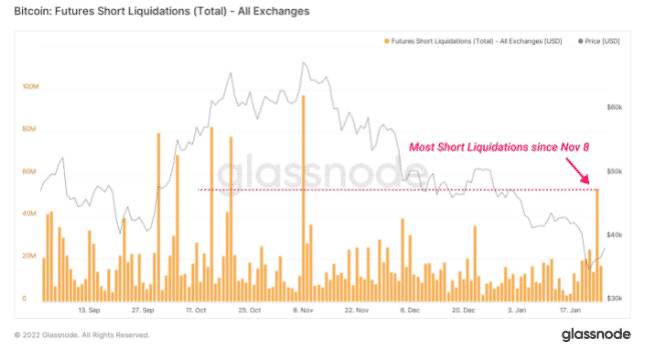

TXMC noted the bounce from $33,000 had liquidated more short-term positions than any point since BTC peaked at $69,000 citing data from Glassnode.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post