Bitcoin still outperforms Stocks and gold a third year in a row despite its bad performance over the past few weeks so let’s read more in our latest Bitcoin news.

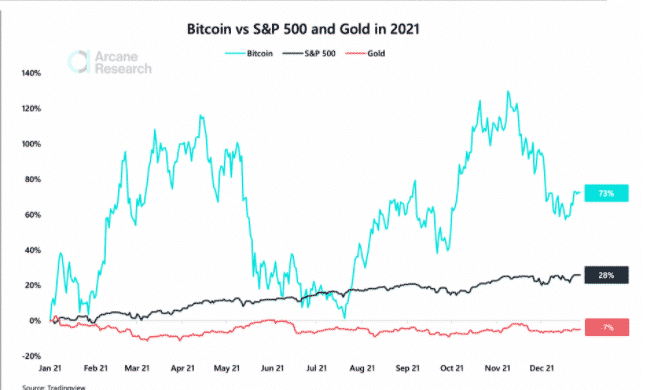

The main concerns are that the cryptocurrency will fall harder than the traditional rivals in 2022 after the US FED policies are imposed. BTC could be down over 30% from its record high of $69,000 but it emerged as one of the best-performing assets in 2021. BTC bested the US benchmark index and gold as well so now the reports from Arcane Research noted in its report that Bitcoin’s year to date performance is at 73%. in comparison, the S&P 500 Index surged 28% and gold dropped by 7% in the same time which marks the third year that BTC outperformed.

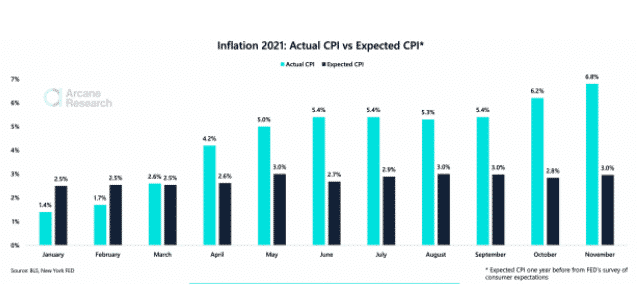

At the core of Bitcoin’s bullish performance, there was higher inflation. The US consumer price index logged its biggest 12-month increase in four decades and the report read:

“Most economists didn’t see the high inflation coming, as witnessed by the 1-year ahead consumer inflation expectations.”

With its 73% gain in the inflationary 2021, Bitcoin proves to be an excellent inflation hedge. Bitcoin holdings increased among the institutional investments vehicles but the loose monetary policies and the fear of higher inflation prompted mainstream financial houses to launch crypto investments vehicles for their clients this year. Arcane reported an inflow of 140,000 BTC on the spot and future-based BTC exchange-traded funds and physically-backed exchange-traded products in 2021. This prompted more BTC units to get absorbed into the investment vehicles and bring more institutional demand for the crypto.

Gold-backed ETFs witnessed an outflow of $8.8 billion in 2021 as per the World gold Council’s reports that were published this December. Bitcoin still outperforms in 2021 despite the periods of high volatility. Most analysts believe that the extreme price fluctuations keep BTC from becoming the ideal inflation hedge including the finance professor at Boston College Leonard Kostovetsky who recalled there had been 13 days in 2021 on which the BTC price moved over 10% in one direction:

“It seems strange to think that a person who is worried about holding dollars because they lost 7% of their value over the last year would be comfortable holding Bitcoin which could (and often does) lose that much value in a single day.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post