Bitcoin’s biggest whale started dropping fast but the smaller whales are multiplying even faster so let’s read more in our latest Bitcoin news today.

The number of BTC whales holding 1000 BTC or more has hit the lowest point since 2021 while the whales that hold 100-1000 BTC multiplied in the past few months. BTC was steadily adopted by a huge number of institutions worldwide this year and some of the crypto’s rarest and biggest ocean dwellers were endangered with Bitcoin’s biggest whales dropping to their lowest point in history. Blockchain journalist Colin Wu tweeted the data from Blockchain metrics site Glassnode earlier this afternoon and it seems that the number of BTC Addresses holding 1000 BTC or more is at a record low of 82.

The last time this number was so low was in December 2012 after bitcoin was launched. Just 81 wallets held 1000 BTC or more and each BTC was worth $13.51. The number one cryptocurrency by market cap is worth $60,757 or 450,000% higher than it was back in 2012. So this data means that the BTC Whales are slowly dying out but as Wu noted later in his Twitter thread, the data from Sanbase records show that the number of addresses holding 100 to 1000 BTC increased dramatically in the past five weeks. Considering that 100 BTC is worth over $6,000,000 more than enough to be considered a BTC whale with the data outlining that mid-tier BTC whales were on the rise since early September.

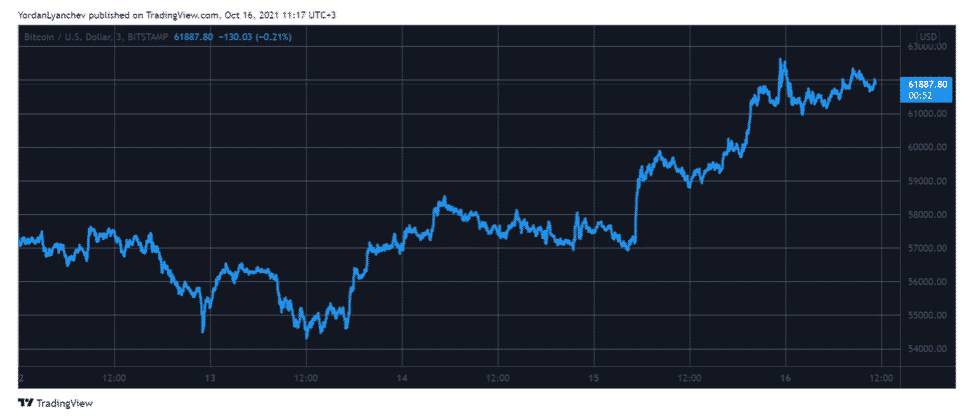

A few major industry developments could have triggered the gold rush with El Salvador’s decision being the first one to accept the currency as a legal tender. The decision was taken in spite of the protests from both the residents and the legal opposition. The markets surged again with the anticipation of the launch of ProShare’s BTC futures exchange-traded fund. The things quieted down a little bit but the ETF will be the first of its kind in the US that will bring the investors a higher exposure to BTC With all of the safeguards of a regulated investment product.

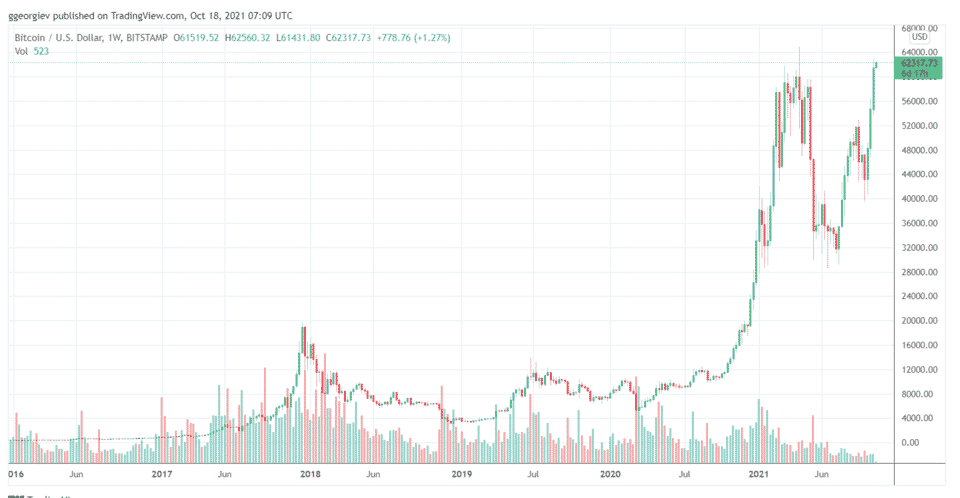

The rise continues with Bitcoin’s surge earlier this year and it set an all-time high of $64,863 before dwindling down to 2021 lows of $29,807 but since then, Bitcoin’s been picking up, and the price today is still not too far off from its all-time high. As per the research by crypto market maker B2C2, the retail investors haven’t been driving the rally but the family offices have. Goldman Sachs survey 150 family offices and noted that about a fifth of them was keen on crypto exposure as a hedge against inflation.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post