Bitcoin’s bulls could correct further before they reach higher highs as the bullish momentum behind the number one cryptocurrency could be fading which usually suggests a correction is underway. In today’s Bitcoin news, we are reading further on the analysis.

The high levels of greed took over the crypto market which is usually a negative sign.

buy kamagra generic https://noprescriptionbuyonlinerxx.com/kamagra.html over the counter

In the meantime, Bitcoin flashed a selling signal that could see it drop towards $12,350 before it aims for higher highs. Investors are growing more bullish about bitcoin thanks to the recent price action but multiple technical and on-chain data shows that a brief correction is underway. Bitcoin made headlines after breaking out of the ascending parallel channel containing the price action since the market crash back in September.

The 12% upswing that followed saw the top cryptocurrency hit new yearly highs as Bitcoin rose to $13,260 for the first time since June 2019 and met channel target. As the number one cryptocurrency breached the infamous $12,000 mark, the social media exploded with activity and the community insider LunarCrush recorded more than 1 billion engagements in October alone. Unfortunately, the high volumes of social mentions in the price pump often lead to short-term consolidation or steep corrections. When looking at the TD sequential indicator on the daily charts, the pessimistic thesis holds. The technical index is now presenting a selling signal in the form of a green nine candlesticks.

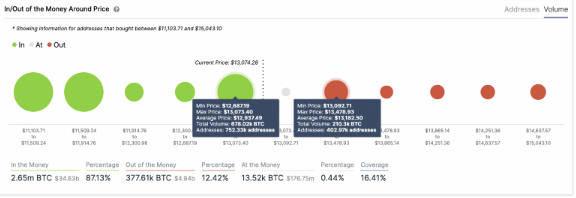

It if gets validated, the bearish formation forecasts a one to four daily candlesticks correction before an uptrend resumes. The increase in selling pressure around the current price levels could see a drop to $12,350 but the pioneer cryptocurrency will have to break through a stiff support barrier between $12,700 and $13,000. About 750,000 addresses have previously purchased about 700,000 BTC according to IntoTheBlock’s IOMAP model. The odds seem to be in bears’ favor but Bitcoin’s bulls could correct it further before the bears are able to jeopardize the bearish outlook. Moving past the high of $13,360, turning this area into support could see BTC increase to $15,000 or higher.

A new wave of developments brought a lot of attention to the crypto market while the publicly-traded companies started buying Bitcoin and PayPal opened the gates for their users to buy and sell crypto. The positive news aligns with the supply shock that the halving has yet to shift the prices. Willy Woo believes that the effects of the block rewards reduction could be around the corner and could “teleport BTC upwards into a full-on FOMO induced bull run.” The high levels of greed among the market participants are a major concern, especially for the short-term price action.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post