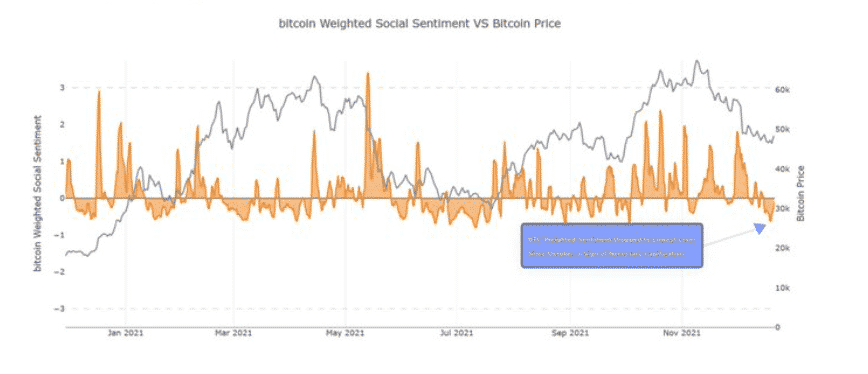

Bitcoin’s market confidence drops as the retail sentiment broke a 30-day low which only confirms the fact so let’s read more in our latest bitcoin news today.

Crypto insight provider Santiment reported:

“Bitcoin’s drop in market confidence and an increasingly bearish bias indicate the lackluster BTC price performance has caused many to capitulate.”

Santiment added that the drop in Bitcoin’s market confidence could be actually a good thing because these drops prompt an upward momentum. The number one cryptocurrency was ranging between K and K even since it gained momentum and dropped to ,000.

buy light pack generic buy light pack online no prescription

Bitcoin was only a step away from the psychological price of $50,000 by hovering near the $49,310 during intraday trading. In the meantime, the holding culture on the BTC market is gaining steam given that the number of addresses that hold more than 10,000 BTC increased to 90.

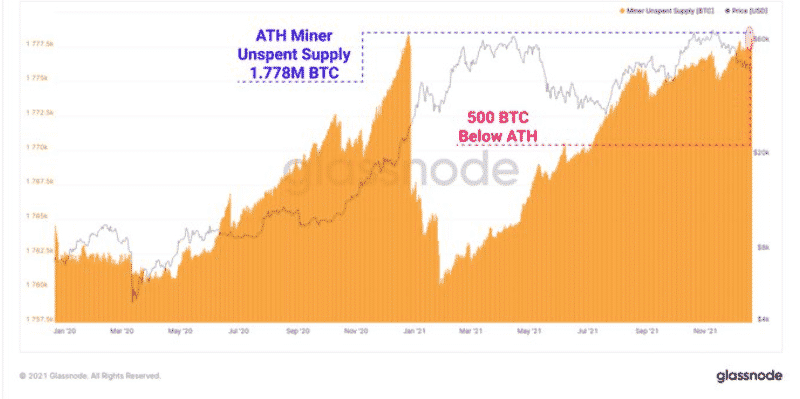

BTC miners also became quite notable holders and signified a trend change since March 2020 as Glassnode explained:

“Bitcoin miner unspent supply is currently sitting just 500 BTC below ATH. These coins are issued to miners as a reward for solving a block but have never been spent on-chain. Miners started HODLing significantly more BTC since March 2020.”

The new wave of green energy programs was experienced in the crypto mining sector and was prompted by the need for environmentally friendly and sustainable activities in regard to mining. For example, EV Battery Technologies is a blockchain tech company that recently launched a commercial emission-free crypto mining solution named Daymak Solar Tree which is meant to make BTC mining more environmentally friendly.

Riot Blockchain is another large-scale American BTC mining company that joined a load resource program by Electric Reliability Council of Texas which is the state’s grid operator in order to make it more sustainable. El Salvador’s decision to use the volcano power and mine BTC set the ball rolling for the need for renewable energy developing in the sector.

As recently reported, The BTC Death cross that pushed the price below $28K reappeared once again and this bearish crossover between the 20-day and 200-day exponential moving average hints at a drop to $40K. The BTC death cross that pushed the price to $28K reappears and it is a market indicator that occurs when the short-term moving average slips below the long-term moving average.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post