BTC worth $670M left centralized exchanges after the FED comments with most investors preferring to have direct custody of the coins when they intend to hold them for a bigger term so let’s read more today in our latest bitcoin news.

Crypto investors stepped up the bitcoin accumulation game and shrugged the prospects of a faster interest-rate increase from the US FED. The blockchain data provided by Glassnode shows that BTC is worth $670M left centralized exchange registering the biggest one-day net outflow in over a month. Crypto exchange BitMEX saw a net outflow of over 9500 BTC. Most investors prefer to have direct custody of the coins when they intend to hold them for a bigger term so the net outflows are taken to represent bullish sentiment.

Outflows don’t imply passive investing and investors often tokenize the coins drained from centralized exchanges on the ETH blockchain to earn more yield. The number of wrapped BTC increased by 13,000 this year and extended the year-long rising trend while WBTC is the first ERC-20 token backed by 1:1 with BTC and represents the cryptocurrency on the Ethereum network. Whatever the case, the increased outflows mean a lot fewer coins available for sale on exchanges and a better chance for the market to increase as well.

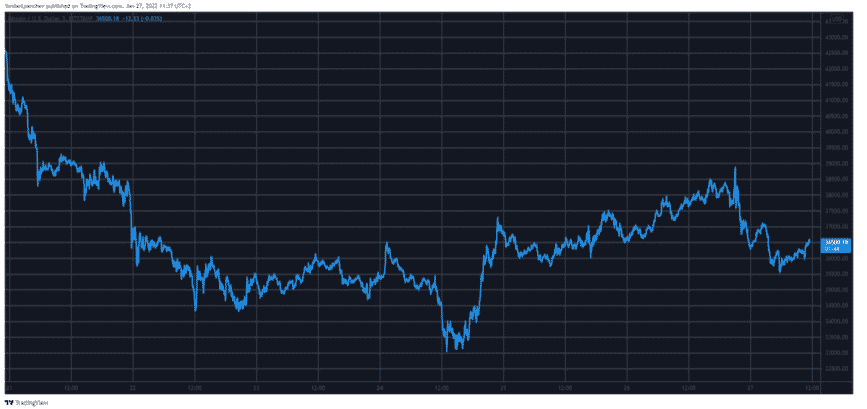

The FED set the stage for a more aggressive withdrawal of liquidity to tame the high inflation. The FED fund futures now priced a five-rate hike of 0.25% for 2022 up from the Wednesday meeting. Bitcoin and other risk assets with fortunes connected to centralized liquidity will remain under pressure with the FED focused on lightning inflation. At the time of writing, BTC was trading nearly to $37,000.

As recently reported, Bitcoin tops $39,000 as the crypto markets lost $100 billion after the recent FED meeting and ETH dropped by more than $200. Bitcoin’s run-up was stopped at $39,000 after the Federal Reserve announced it will increase the interest rates in March. The altcoins which were heading north dropped right after Bitcoin. After last week’s bloodbath where the main cryptocurrency dumped by over $10,000 in a few days to a six-month low below $33,000, the market is more positive in the past 72 hours. The asset recovered $4000 in one day before another leg up drove it to around $37,000 and during the trading day, BTC kept on climbing and tapped a six-day high of $39,000.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post