Here is a quick crypto news recap from last year on PayPal’s new policy targeting Bitcoin:

- In April 2018, PayPal revealed that it is updating its privacy policy to ban unverified accounts

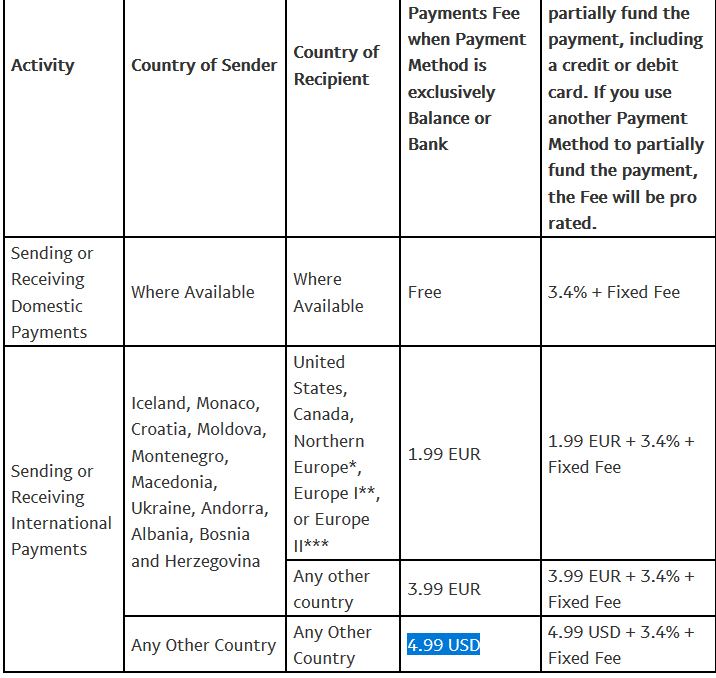

- US users sending funds outside the US will have to pay a $4.99 fee which is more expensive than sending money through Bitcoin

- Bitcoin’s transaction fee which is less than $0.2 makes the most dominant cryptocurrency a way more viable option to transfer money – as well as a more private one

Last year, the leading payment processor PayPal has announced new fees and restrictions that could have a massive impact on the cryptocurrency market. Knowing that cryptocurrencies offer low-fee and even fee-less forms of value transfer, PayPal dwarfed the competition with global adoption and brand awareness. The company even pointed to the ease of handling eBay transactions, personal funds and business funds that is going to happen on the platform real soon.

A $4.99 Fee For US Users Sending Payments Abroad (Plus 2.9% Charge If The Transaction Is Filled With A Credit/Debit Card)

Basically, PayPal’s new policies include a $4.99 fee for US users sending international payments (plus a 2.9% charge if the transaction is filled with a debit/credit card). There are similar measures implemented for users in other countries too. While the fees are not staggering, the new policies make international micro transactions unviable.

buy zithromax online https://buynoprescriptionrxonline.com/dir/zithromax.html no prescription

Even though Bitcoin once had higher fees than PayPal has now, the things have changed. Currently, sending a Bitcoin transaction is possible in under an hour for around Currently, sending a Bitcoin transaction is possible in under an hour for around $0..

buy zydena online https://buynoprescriptionrxonline.com/dir/zydena.html no prescription

21 which is absolutely cheaper compared to PayPal. Despite the speed of PayPal, Bitcoin is currently many times cheaper and has an advantage of massive international awareness.

Fees Are Massively Increased, Making Small Transactions On PayPal Unviable

The massive increase in PayPal’s fee structure for sending money abroad definitely makes small transactions completely unviable and results in making feeless cryptocurrencies a more attractive option – especially in times when Bitcoin is hitting new records for its low fees and cost-effective methods of transferring funds at $0.029 per transaction on average.

What’s interesting is that PayPal won’t stop here. They will continue updating the fee structure and will certainly add new policies in the future. Their announcement has introduced policies surrounding user privacy too, stating:

“We’re changing the balance functionality for your PayPal account depending on whether we have been able to verify identifying information that you provide to us. If we have not verified your identifying information, a balance in your PayPal account can generally only be held in your PayPal account and transferred to a linked bank account or debit card.”

Linked bank cards generally require identification in the first place. This is another thing that makes PayPal vulnerable for many – and a thing that makes Bitcoin and other cryptocurrencies appealing.

Could Cryptocurrencies Like Bitcoin Replace PayPal?

As the most dominant cryptocurrency out there, Bitcoin is now a cheaper way to transfer funds when compared to PayPal. With a fee of less than $0.2 at the time of writing, Bitcoin is definitely more private and cost-effective when sending payments.

On a more general note, cryptocurrencies are far more appealing way of sending interpersonal payment. More secure and more affordable, they definitely enter a position of competing with the biggest online payment system in the world.

Frequently Asked Questions (FAQ) On PayPal Vs. Bitcoin: Transaction Fee Comparison

Below, we are listing some of the most common questions when it comes to Bitcoin vs. PayPal and the transfer of money through both platforms.

- Who offers better exchange rates for transactions?

If you are sending $1,000 to the UK from US, you need to look at the mid-market rate. While PayPal takes $4.99 out of your account for the transfer and an additional margin of 2.5%, it is easy to see that Bitcoin and its $0.2 transaction rate is a better option. The best way to find a good exchange rate, however, depends on your choice of a Bitcoin platform.

- Who offers lower fees for transactions?

If you are depositing money through Bitcoin, you are expected to pay $10 for a wire transfer and the ACH transfers are free. If you are buying Bitcoin from a US bank account, the fee is 1.49% with a $0.15 minimum, same like the one on the Coinbase USD wallet. If you are buying Bitcoin with a credit or debit card, the fee is 3.99%.

For sending money to another PayPal account within the US and Canada, there are no fees. However, for paying with credit or debit card or PayPal Credit in US and Canada, there is a 2.9% fee plus a fixed amount of about $0.30. For other countries, PayPal charges $2.99 to $4.99 depending on the country for using the PayPal balance – and 2.9% plus a flat fee that depends on the specific country you are sending the funds to as well as the fee based on the currency.

Lastly, the best way to know the fee structure is by using a Bitcoin vs. PayPal calculator that shows you the fee breakdown for sending any amount to any country from the United States.

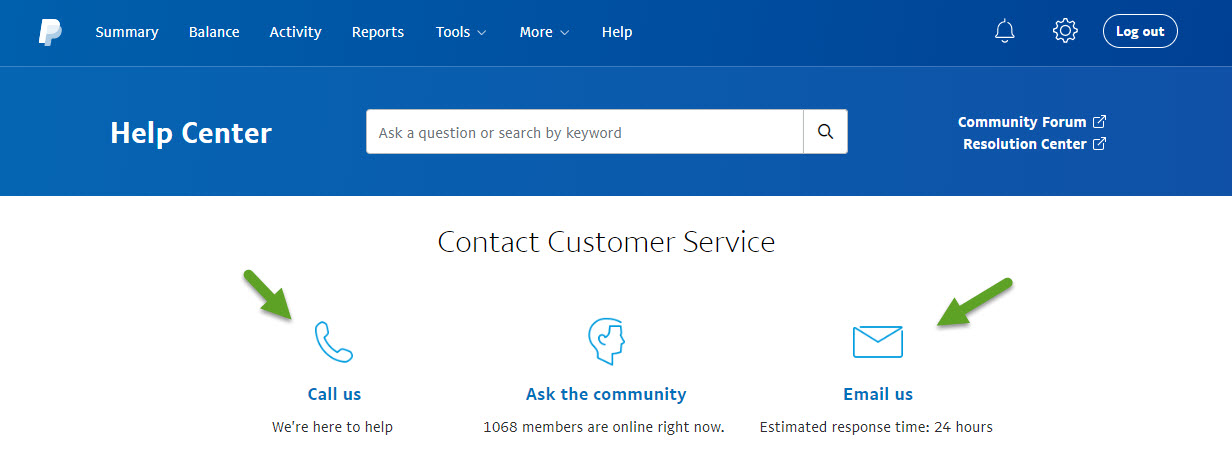

For any questions in relation to the latest PayPal Policy, Make Sure To Click The PayPal Contact Us Button

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post