The BTC demand goes downwards with the institutions moving into DeFi according to the genesis Q3 report showing that the crypto market is growing but it has its setbacks as institutions turned to DeFi as we are reading more in our Bitcoin news today.

Genesis recently published its Q3 market observations report showing some of the major trends acorss the market and this time it shows the demand for BTC slowing down during a Q3 period as institutions are getting more into Defi and altcoins. According to the report, the BTC demand trended downwards during Q3 because of the lack of opportunities for the traders to profit from spreads between BTC spot prices and futures markets.

The company also noted a huge structural change in the market starting with the deleveraging of the retail exchanges and in Q2 there were several exchanges that started limiting their leverage offerings such as Binance which reduced the levels to a max of 20x for the accounts opened within 30 days. The Genesis report reads:

“In Q1 2021, Genesis first noted a significant decline in the weighting of BTC in our overall portfolio due to the relative lack of BTC-denominated trading opportunities. While this paused in Q2, it resumed over the third quarter due to the continued GBTC premium inversion and flattening of the basis curves.”

The deleveraging of the retail exchanges noted that with the Chinese crackdown on crypto we will see a shift towards institutionalization in the industry that will only make Bitcoin less attractive to opportunist traders. The company outlined there was a growing number of institutions that are coming into the Defi space and the documents so reported a huge appetite in ETH From the institutions to borrow and to lend across decentralized applications. The emerging layer-1 protocols saw a huge spike in interest with plenty of crypto-native institutions exploring yield opportunities that will provide some decent rates for stablecoins and ETH/BTC pairs.

buy propecia online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/propecia.html no prescription

This also led to an increase in the price for altcoins that continued to gain in the third quarter.

One of the biggest gainers that we saw was of course Solana, as it managed to surpass Cardano after a new all-time high this week. The Genesis report noted that as the BTC demand goes downwards, SOL surged:

“Alongside greater interest in ETH loan originations during the quarter, altcoins (alts) – and particularly L1 alternatives – saw a boost in demand, serving as natural liquidity pairs for DeFi yield opportunities.”

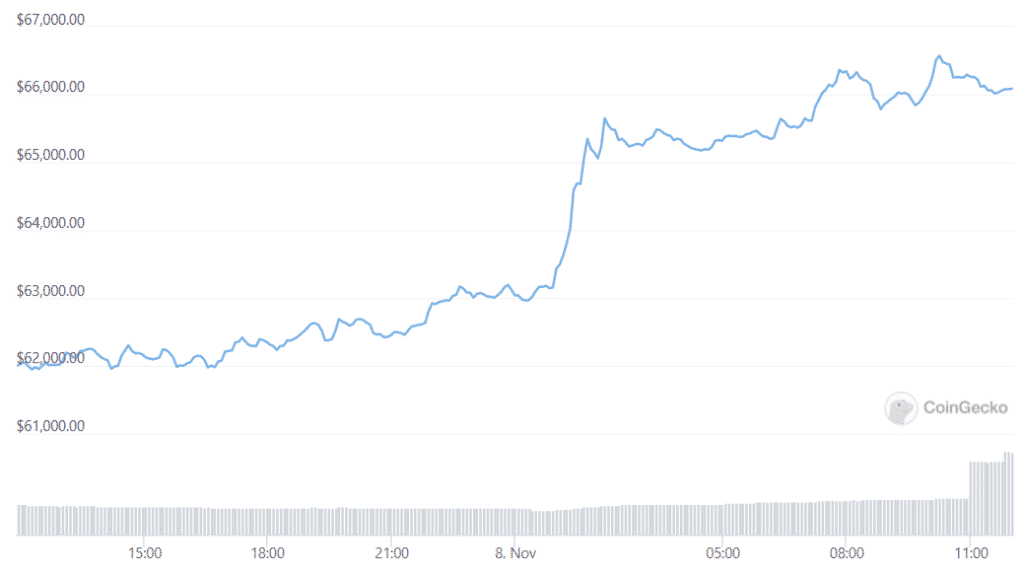

Despite the lack of interest in BTC, the anticipation of the US first futures-linked BTC ETF revived the market with the traditional financial institutions such as investment banks and asset managers showing a huge interest in the product. In total, Genesis traded over $37 billion for spot and derivatives in the third quarter as BTC accounted for roughly 61% of the over-the-counter trading activity of Genesis, or increasing up by 47% in the third quarter.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post