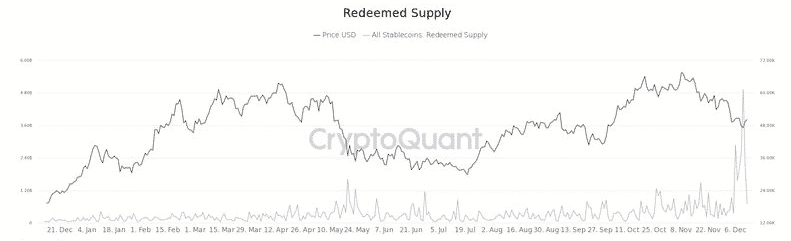

Whales start cashing out as the stablecoin redeemed index surges and reaches an all-time high of below $5 billion as we can see more today in our cryptocurrency news.

The redeemed index supply across all stablecoins surged to an all-time high of $5 billion a few days ago so now one analyst thinks that this is a clear indicator that Whales start cashing out. According to the data from CryptoQuant, the number of redeemed stable coins on the board hit an all-time high on December 10. As seen in the charts, the number reached $5 billion when the BTC price was set at $47K.

CryptoQuant’s Dan Lim thinks that this could be an indicator of whales cashing out. He opined that this could be in response to the upcoming FOMC meeting which will take place on December 16th although not being sure if the whales are chasing the market’s volatile response to the FOMO announcement but it is one of the uncertainties. It’s worth noting that this doesn’t mean that the whales are starting to sell BTC now but this could be perceived as a negative indication in the price rallying in the past few days followed. Bitcoin’s price reached an intraday high of $50,800 before getting rejected and pulling back to where it now trades at $48.7K.

As recently reported, the inflation news from the US pushed BTC to $50,000 again but then Bitcoin dipped by $3000 so it is now hovering near $47,000. Most altcoins are in the red as well on a daily scale as ETH dropped to $4000. The past few days didn’t go well for the main cryptocurrency and tried to recover from the past week’s crash and challenged the $50,000 mark on a few occasions but that wasn’t helpful. Being unable to break above, the cryptocurrency hovered near $47,500 when the US Bureau of Labor Statistics revealed the highest inflation number in 40 years set at 6.8%.

This had an immediate effect on the BTC price that jumped a few thousand dollars and reached $50,000. As it happened with other attempts, the asset was not able to pass by and the rejection drove it south by about $3000. after dumping below the $47,000 level, BTC bounced off well and now sits above $48,000 with the market cap being north of $900 billion. The second-biggest digital asset went higher than $4400 a few days ago but the negative sentiment brought it to $4000 and as of now, ETH stands above the line.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post