The Young BTC addresses seemingly sold 36% of their holdings at a loss according to the on-chain data analysis that showed the behavior of traders during the recent market crash so let’s read more in today’s latest Bitcoin news.

According to the data from IntoTheblok, the young BTC addresses holding BTC for less than a month decreased their supply as BTC crashed by $10,000 in less than a week. Bitcoin went through one of the worst corrections in terms of USD value in the past few weeks and the asset even traded above $43,000 before it dumped by $10,000 to a six-month low below $33,000. during such turbulence, history shows that the long-term BTC holders stick to their positions but even some buy the dip whcih is seen by the whales and even the first country which legalized the asset and that is El Salvador.

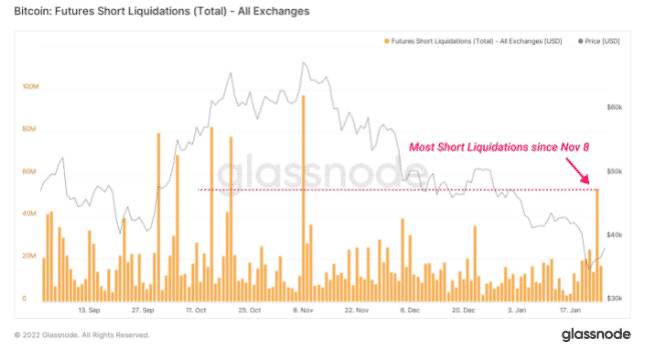

Who's been selling #Bitcoin?

Our Balance by Time Held Indicator shows how the traders – addresses holding for <1m, decreased their supply by 36% over the past 30 days

These traders followed the price action of $BTC, and as the price started to fall, they sold at a loss pic.twitter.com/zHaocHj0Yj

— IntoTheBlock (@intotheblock) January 27, 2022

However, those that entered the market recently are not really used to Bitcoin’s enhanced volatility and the fast pace corrections that feel differently. As it happened plenty of times in the past when BTC’s value dropped by double-digit percentages in a short while, these investors dispose of huge portions of holdings. Something similar happened during the recent correction according to the data from IntotheBlock.

buy levitra online pridedentaloffice.com/wp-content/themes/twentytwentyone/inc/en/levitra.html no prescription

The resource’s Balance by Time Held indicator revealed that BTC investors holding for less than a month reduced their BTC supply by 36% on a monthly scale. IntoTheBlock concluded that these traders followed the price action of BTC as the price started falling and they sold at a loss.

As recently reported, Bitcoin returned to $37K when the Wall Street traders opened up and watched for a new resistance retest with the coin evading the major resistance test. The data shows that the BTC/USD pair is returning to form a new high after a new dip to $36,175 on Bitstamp. As a part of the range-bound behavior, the hopes were held high that the momentum will continue to challenge the resistance levels closer to $40,000 whether or not the outcome will be a fresh correction.

Fellow trader Anbessa reiterated the demands for $38,500 to hold and proclaim the corrective phase as complete for BTC. The low funding rates are combined with an improving scenario acorss the derivative market which is something that can spark an upwards trend. Rekt Capital outlined the area for BTC to reclaim to rekindle the bullishness on longer weekly timeframes and this will come in the form of $39,600 as a weekly closing price.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post