Plus500 is a trademark of Plus500 LTD which has a principal activity of online trading in contracts for difference or CFDs that are delivered thorugh a proprietary trading platform via the internet and other electronic channels.

Founded in 2008, the Israeli company operates via several subsidiaries in Europe and the Asian Pacific region and it is registered with relevant regulatory authorities. Like most forex brokers, Plus500 doesn’t accept US traders. According to the “country by Country” report on the website, Plus500 LTD is a publicly traded company that has been listed on the London Stock Exchange since 2018 and its market cap reached $1.60 billion in 2020.

Plus500 UK LTD is a UK-based company that has offices located in the City of London and is authorized and regulated by the Financial Conduct Authority. The broker offers clients in more than 50 countries access to comprehensive product lines like stock indices, forex, individual shares, ETFs, options and commodities, and crypto. Plus500 is also the first broker to introduce a CFD in 2013 and advertises that all trading costs are contained in each instrument spread. The broker offers access to the options trading on many markets. These are very similar to the plain call and put options traded on the exchanges but they are not standardized which means that the option premium can be customized for the risk tolerance and strategy objectives.

Plus500 is for the individual or entity which seeks access to teh wide range of financial markets with low trading costs and a simple platform where users can place their trades. The exchange product suite of 2000 and more trading instruments, offered on its proprietary WebTrader with competitive spreads and no commissions that should entice the experienced investors that prefer to transact manually and finds the lowered cost worth the lack of the added functionality which some competitors offer.

Pros And Cons

Some of the benefits for the exchange include:

-Access to more than 2000 trading instruments

-Easy to use platform

-Regulated by the FCA

-Negative balance protection for client accounts

-Guaranteed stop-loss orders

Pros Explained

The exchange offers clients in more than 50 countries access to a comprehensive product line like stock indices, forex, shares, ETFs, commodities, and crypto. Web Trader has a simple and easy-to-use interface that allows you to create watchlists, analyze charts as well as place and monitoring of trades.

The platform is regulated by the FCA which is one of the main regulatory agencies in the UK and it is highly regarded globally for being strict in ensuring market practices are fair for individuals and businesses. Being regulated by a reputable government agency is a great way to ensure the credibility of the company.

The exchange offers negative balance protection which is mandated under the EMSA rules that went into effect in 2018, ensuring that clients cannot lose more than they put in their account. Guaranteed stop-loss orders protect the traders from market gap risks and they are available on some instruments depending on the market conditions.

Some of the cons include:

– Weak customer support

– Low on educational resources

-Doesn’t accept US clients

Cons Explained

The customer service options are limited to online chat and email support with the lack of a telephone number, for sales inquires being the best option. The exchange offers little to assist clients in learning about the markets in which they are investing and the research resources which are below industry standards.

Plust500 doesn’t accept US clients because of the regulatory constraints which will be a major red flag were it not for the fact that the company is under regulation by the FCA which along with the US regulatory agencies and it is widely considered to be a preeminent regulatory body. Advanced traders that rely on incorporating third-party analytical and automation tools in their trading process will be disappointed as none of these tools can be integrated directly with WebTrader so back-testing functionality is not available either.

Plus500 Costs

Plus500 generates revenues principally from customer trades that “cross” the bid/ask spread which is competitive within the industry. The company doesn’t charge commissions on any client transactions as well trading costs are contained in the spread of the instrument. While the spread doesn’t vary with teh trade size, Plus500 offers high-volume traders a discount.

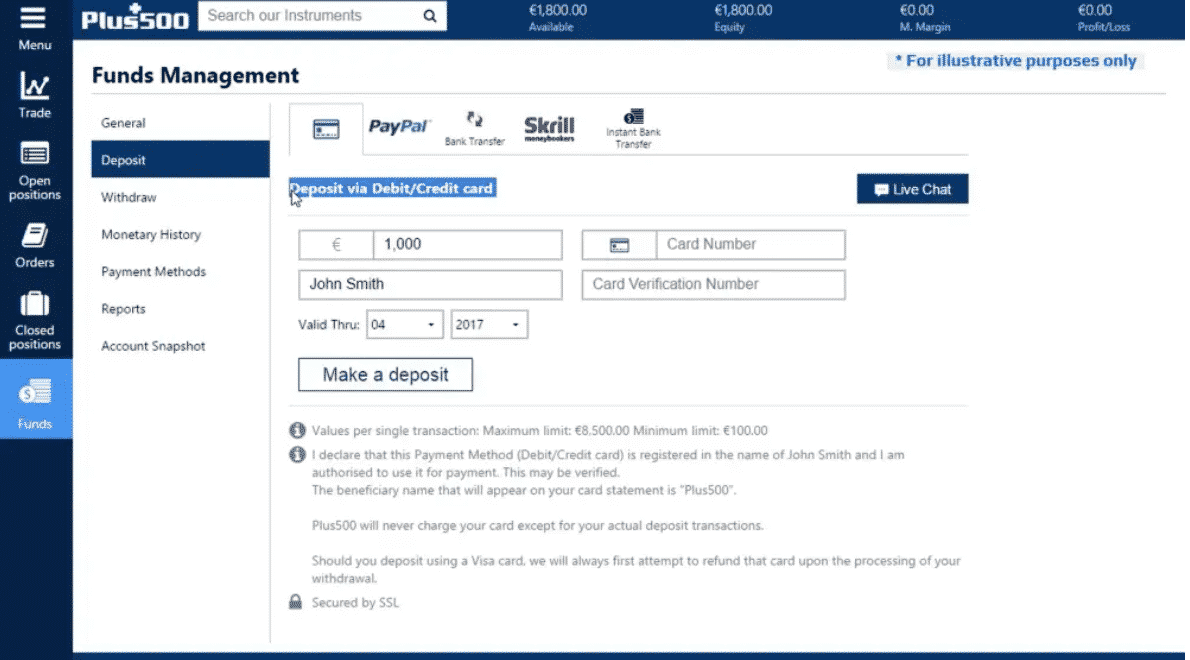

The broker generates revenues by charging premiums, a financing charge on positions held overnight by the clients which could be subject to currency conversion charges if they trade in the currency other than the account’s base currency. There are fees for guaranteed stop-loss orders and the inactivity fees kick in after the account is idle for three months.

Traders can qualify for a professional account that offers high leverage but the costs are the same. Investors with a professional account could increase maximum leverage ten times from 1:30 to 1:300. One of the major selling points is that it does not subject client accounts to ancillary fees. There are no charges for normal withdrawals or terminating accounts and the minimum to open the account is 100 units of the base currency. Funding options include MasterCard, Visa debit/credit cards, e-wallets, and bank funds transfers.

Trading Experience

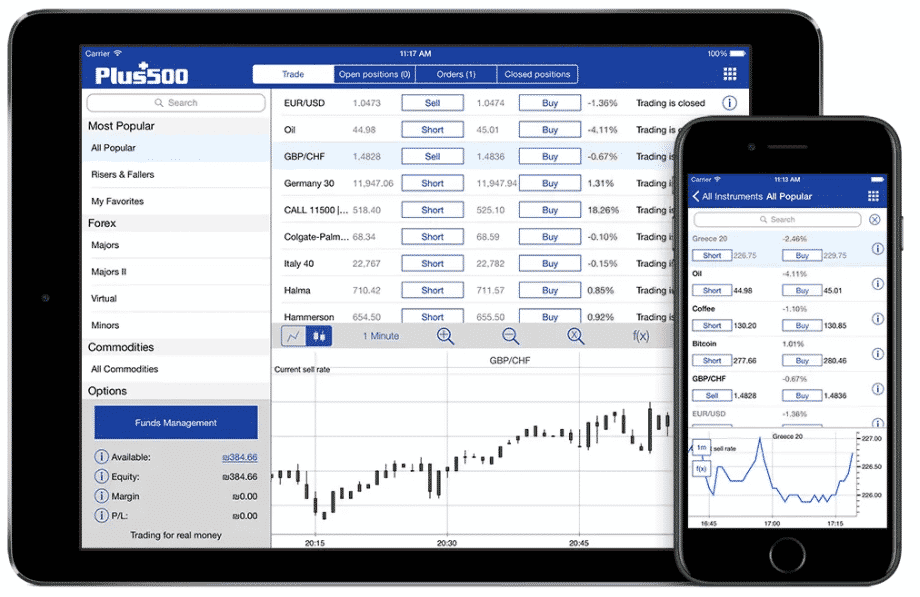

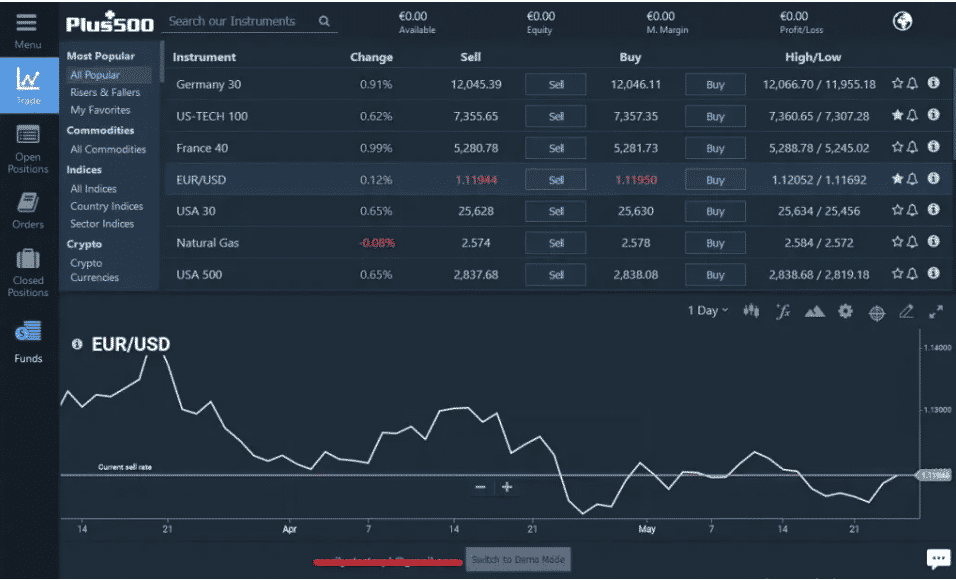

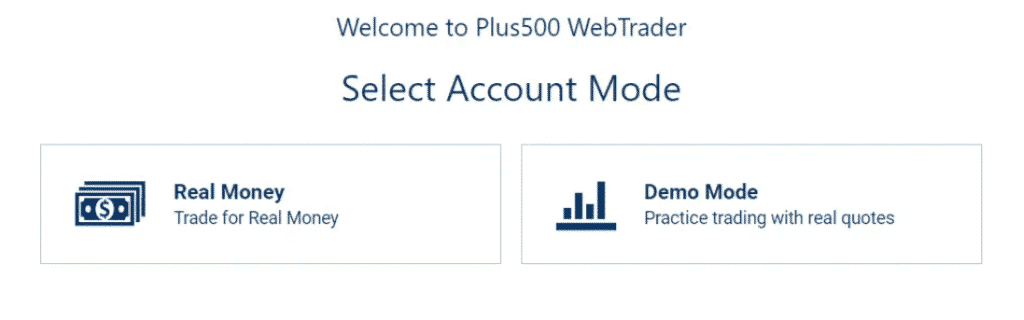

WebTrader as its proprietary platform offers a streamlined trading experience that is stable and easy to access from other devices and systems. WebTrader has a simple and easy-to-use interface that allows you to create watchlists, analyze charts, and well place and monitor trades.

The technical analysis charts offer more than 100 technical indicators that you can apply to most time frames from tick charts to weekly charts. Unlike most of its competitors, Plus500 doesn’t offer a popular MetaTrader 4 platform which is an alternative that will provide more functionality and customization options for clients.

The most appealing feature of WebTrader is that it is very easy to use with layouts that will feel familiar to experienced traders. The clients can choose from more than 2000 tools and will be able to analyze their selection on a customizable technical analysis chart and place trades in just a few clicks. WebTrader is a closed system unfortunately and advanced traders that rely on incorporating third-party analytical and automation tools in the trading process will be disappointed as none of the tools can be integrated with Webtrader.

This platform doesn’t offer any of the special features that are available at other online forex brokers. It doesn’t allow for automated tradign via expert advisors and it doesn’t provide back-testing functionalities. It also doesn’t allow clients to manage third-party funds via MAM trading platforms. The company provides a streamlined Web Trader platform along with similar mobile trading apps for Ipad, iPhone, and Android devices.

Range of Offerings

Plus500 offers access to more than 2000 financial instruments across a wide range of different asset classes like indices, forex, commodities, individual shares, ETFs, options and crypto.

Plus500 Customer Service

The customer service options are limited to online chats alone and email support. The glaring omission is the lack of a telephone number for sales inquiries. The prospective and current clients have to submit inquiries via live chat or an email ticketing system which is available 24/7. The customer service options are limited as no in-person support is available.

The online chat is simple to use but the initial responses to requests feel like a chat-bot that is being used. This isn’t a problem because the software is good at detecting commonly asked questions and linking to resources in the FAQ with short answers provided.

Email responses for average spread information on EUR/USD and USD/JPY are slightly strange in that they weren’t willing to disclose. Plus500 states that its revenue is derived from a spread which will imply that the data will be collected and disclosed to prospective clients.

Education

Most brokers provide courses, quizzes, e-books, and more to help clients learn about the markets in which they are investing but Plus500 provides none of these services. The broker doesn’t provide a legally required Key Information Document which outlines the basics of what each instrument is about and the risks associated with trading ti. The KID has summary information on the crypto, ETFs, forex, commodities, indexes, options, and equities.

Security

The company acts as principal and hedges exposure with the parent company to eliminate market risks and to ensure that it is not exposed to material losses. While it does not provide additional deposit insurance, it is registered with regulatory authorities in Europe and the Asian-Pacific region. Plus500 LTD is regulated by the Financial Conduct Authority, Office Address: Plus500UK Ltd, 78 Cornhill, London EC3V 3QQ.

In accordance with the client money rules, Plus500 is required to take steps and ensure client funds are not commingled with the corporate funds, and this way it safeguards client money in an event when the company becomes insolvent. If Plus500 defaults, any shortfall of funds up to $80,000 may be compensated under the FSCS.

Conclusion

Plus500 targets those that are looking for an interface with conducting trades without the need for advanced functionality. The spreads are competitive, costs are low and the WebTrader platform is intuitively functional. The lack of educational and research resources that don’t provide MT4 as an alternate platform, makes the broker unsuitable for beginners but experienced investors can find the functionality trade-off worth it.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post